The United Auto Workers (UAW) has reportedly secured a unique agreement with Rivian Automotive (RIVN), according to Bloomberg. The deal includes Rivian taking a neutral stance toward unionizing efforts at its Illinois factory, where its EVs are produced. However, this neutrality will only take effect if Rivian meets certain profitability milestones.

Don't Miss Our New Year's Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The agreement could give the UAW a clear path to organize Rivian’s workforce if the company achieves profitability. For Rivian, this deal may ease labor tensions at a crucial time as it focuses on ramping up production of its flagship vehicles to improve financial performance. It also acts as an incentive for the workers who do want to unionize to make sure the company succeeds in turning a profit.

If the UAW successfully unionizes Rivian, it could pressure other EV makers like Tesla (TSLA) to increase wages in order to stay competitive when it comes to attracting talent. Unionization would require Rivian to collectively bargain on wages and working conditions and give workers more influence over company decisions.

How Unions May Benefit Shareholders

Interestingly, although unions can be a headache for management and lead to potential strikes, they can actually be beneficial for shareholders thanks to one particular feature – no stock-based compensation. Typically, union workers do not receive stock-based compensation as part of their standard employment contracts because it can be riskier and less predictable than guaranteed wages or benefits. This is good for shareholders because it leads to less share dilution and makes any potential buybacks more effective in the long run.

However, it is worth mentioning the drawback to such an arrangement, which is higher cash expenses. Indeed, higher wages do mean an instant outflow of cash that impacts free cash flow figures. As a result, this increases the risks of a cash crunch if a company hits a rough patch.

Is RIVN Stock a Buy or Sell?

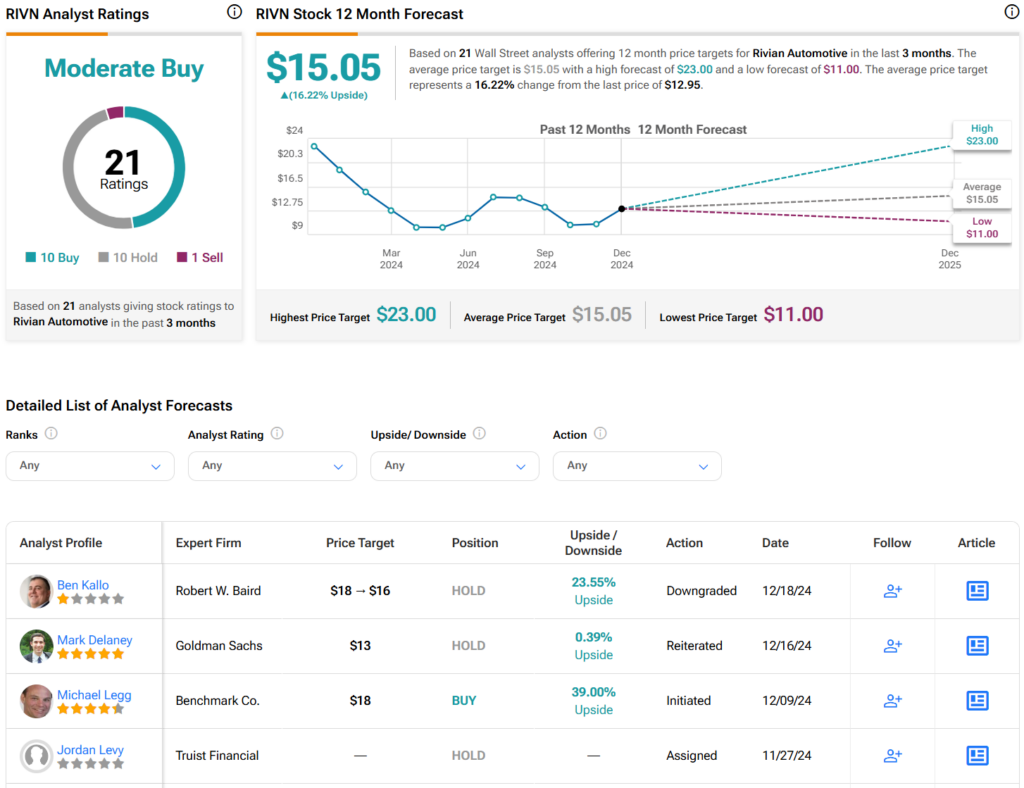

Overall, analysts have a Moderate Buy consensus rating on RIVN stock based on 10 Buys, 10 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 44% decrease in its share price over the past year, the average RIVN price target of $15.05 per share implies 16.2% upside potential.