Shares of Rivian (RIVN) are sinking today after a Bloomberg report noted that the EV maker’s factory in Normal, Illinois, has accumulated 16 serious OSHA (Occupational Safety and Health Administration) violations in 21 months. These incidents included an amputated finger, a cracked skull, and workers vomiting after being exposed to paint without proper protection. Despite being a smaller manufacturer, Rivian’s violation count surpasses that of larger automakers like Ford (F).

Some workers, such as Addison Zwanzig, reported severe health issues after being instructed to paint vehicles without respirators, which resulted in her vomiting blue bile. It was only after these incidents that proper safety equipment was provided. Rivian responded by stating that safety is a priority and claimed the Bloomberg report misrepresented facts. The firm highlighted the improvements it has made and noted that it only received two serious OSHA citations in 2023.

Despite these safety concerns, Rivian continues to hire more employees and has changed its plans to build the R2 SUV at the Illinois plant instead of Georgia. However, the firm will need to be careful to not neglect safety measures now that it has been spotlighted by the media.

Is RIVN Stock a Buy or Sell?

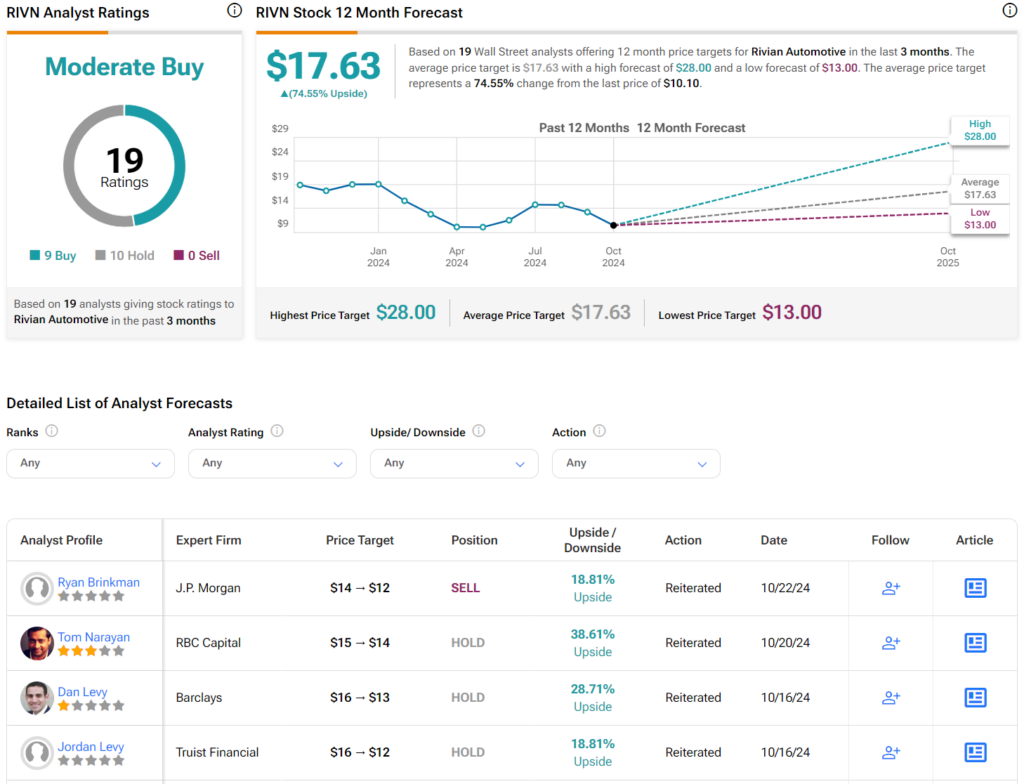

Turning to Wall Street, analysts have a Moderate Buy consensus rating on RIVN stock based on nine Buys, 10 Holds, and zero Sells assigned in the past three months. After a 42% decrease in its share price over the past year, the average RIVN price target of $17.63 per share implies 74.55% upside potential.

Interestingly, a look at the image below shows analysts cutting their price targets on Rivian stock. Indeed, the most drastic cut came from Jordan Levy of Truist Financial, who reduced his target from $16 per share to $12 per share.