Rio Tinto (NYSE: RIO) has announced disappointing production results for the fourth quarter of 2021 and full-year 2021 on a year-over-year basis. The key reason behind this is challenging operating conditions due to COVID-19.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

2021 Production Details

The company said that its Pilbara iron ore production declined 4% to 319.7 million tonnes in 2020. The downside can be attributed to above-average rainfall in the first half of 2021, cultural heritage management and delays in growth and brownfield mine replacement tie-in projects.

Bauxite production fell 3% in 2021, marred by rains in the first quarter, equipment reliability issues and overruns on planned shutdowns at the company’s Pacific operations. Titanium dioxide slag production too declined 9%.

Aluminium production of 3.2 million tonnes was 1% lower year-over-year on account of reduced capacity at Kitimat smelter due to the strike that commenced in July 2021. Further, mined copper production fell 7% on lower recoveries and throughput at Escondida as a result of the prolonged impact of COVID-19.

2022 Progress

The company entered into some new partnerships during the fourth quarter of 2021 to accelerate decarbonising of its business and the value chains they operate in. Also, it said a significantly larger programme is planned for 2022, subject to COVID-19 constraints, with the Rio Tinto Safe Production System (RTSPS) rollout of up to 30 deployments at 15 sites as well as up to 80 rapid improvement projects that aim at improving targeted bottlenecks.

The Chief Executive at Rio Tinto, Jakob Stausholm, said, “We are seeing some initial positive results from the implementation of the Rio Tinto Safe Production System, which we will significantly ramp up in 2022, as we continue to work hard to improve our operational performance to become the best operator.”

For 2022, Rio expects iron ore shipments from the Pilbara region of 320 million to 335 million tones and mined copper output of 500,000 to 575,000 tones.

Stock Rating

Last month, Jefferies analyst Chris LaFemina maintained a Hold rating on Rio Tinto and lowered the price target to $65 from $71. The new price target implies 13.8% downside potential from current levels.

The stock has a Moderate Buy consensus rating based on 1 Buy and 2 Holds. The average Rio Tinto price target of $65 implies 13.8% downside potential.

Positive Sentiment

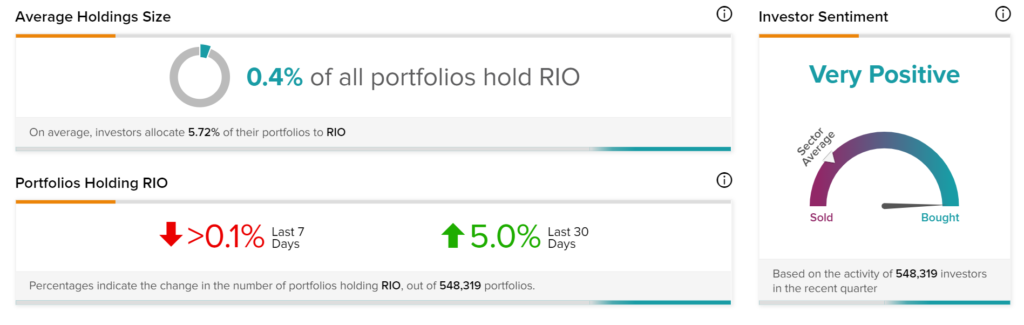

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Rio Tinto, as 5% of investors on TipRanks increased their exposure to RIO stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

AbbVie’s RINVOQ Receives FDA Approval; Street Says Buy

J.B. Hunt, Waymo Via Strike Strategic Alliance

Meta’s VR Unit Faces Probe by FTC and Three U.S. States — Report