Rio Tinto Limited (AU:RIO) officially approached Arcadium Lithium (AU:LTM) (ALTM) with a proposal for a potential acquisition amid a lull period for the lithium market. If completed, the deal would position Rio Tinto as one of the top global lithium suppliers once the market recovers, enabling it to meet the rising demand for the metal crucial for clean energy transition. According to Rio, the approach is non-binding, and there is no guarantee that a transaction will be finalized or move forward.

Following the announcement, Arcadium shares on the ASX surged 47% as of writing, whereas RIO stock fell over 2%.

Based in Australia, Rio Tinto is engaged in mineral exploration, mining, and processing activities. Meanwhile, Arcadium Lithium is a dedicated lithium producer, established through the merger of Allkem and Livent in January 2024.

Rio Tinto Targets Arcadium Ahead of Lithium Price Recovery

Through this deal, Rio aims to capitalize on the anticipated recovery in lithium prices. Notably, lithium prices have witnessed a huge decline since January 2024, primarily due to oversupply from China. As a result, Arcadium shares have dropped over 40% year-to-date, making the company an appealing acquisition target.

Looking ahead, lithium prices may encounter difficulties in recovering in the medium term, but the market remains optimistic for the long haul. Lithium is expected to benefit from the expansion of EVs (electric vehicles) and the rising demand for renewable energy.

Additionally, lithium demand is expected to soar later this decade, fueled by the growth in lithium-ion batteries.

Is Rio Stock a Good Buy Now?

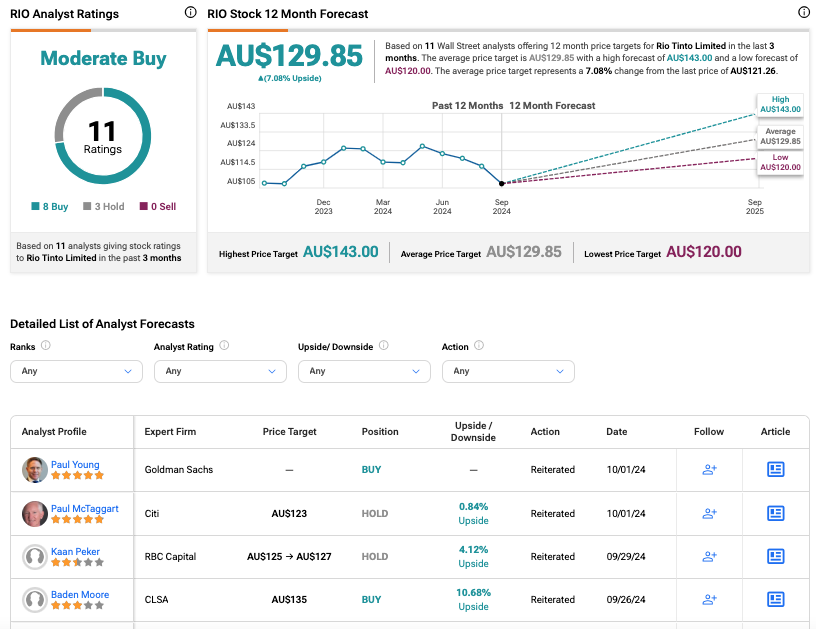

According to TipRanks, RIO stock has received a Moderate Buy rating based on 11 recommendations, of which eight are Buy. The RIO share price forecast is AU$129.85, which is 7% above the current trading level.