RH (RH) posted strong Q1 results on the back of adjusted earnings that soared 285% year-over-year. RH is an American home-furnishings company.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Following the announcement, shares of the company spiked 6.7% in Wednesday’s extended trading session after closing 2.8% lower on the day.

Earnings came in at $4.89 per share, beating consensus estimates of $4.10 per share.

The company’s revenues of $860.8 million surpassed the Street’s estimates of $757.7 million and jumped 78% from the year-ago period.

RH CEO Gary Friedman said, “While fiscal year 2021 will surely be a tale of two halves, there are many data points that lead us to feel optimistic that our strong performance will continue through the second half of 2021 with growth reaccelerating in fiscal year 2022 and beyond. These include a strong housing and renovation market, both with pent up demand and a long tail, a record stock market, low-interest rates and the reopening of several large parts of our economy.” (See RH stock analysis on TipRanks)

For Q2, the company expects revenue to increase in the range of 35% to 37%. For 2021, the company now expects net sales to increase in a band of 25%-30% compared with a 15-20% increase expected earlier.

Following the Q1 earnings release, Wells Fargo analyst Zachary Fadem reiterated a Buy rating on the stock but increased his price target to $725 from $700. This implies 18.6% upside potential from current levels.

Fadem said, “RH is clearly executing in a period of elevated demand and with LT growth levers accelerating in the second half of FY22 (European expansion, Contemporary, Guesthouse, etc.), we see more ways to win.”

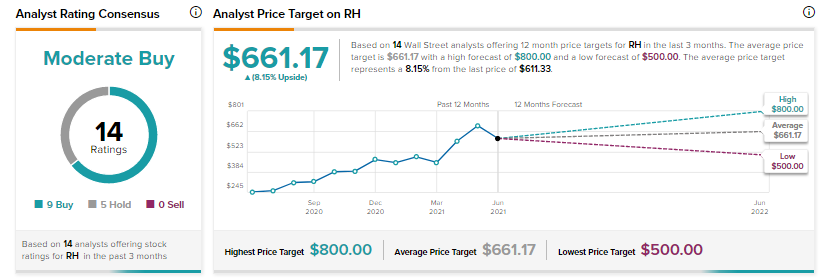

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 9 Buys and 5 Holds. The RH average analyst price target of $661.17 implies 8.2% upside potential from the current levels. Shares have increased 35% over the past six months.

Related News:

Seagate Technology Increases Q4 2021 Guidance; Shares Rise 2.2%

Casey’s General Q4 Earnings Beat Expectations; Street Remains Cautiously Optimistic

Pegasystems Gives Green Light to Expand Share Buyback Program; Shares Jump 3.2%