RH (RH) delivered stellar second-quarter results with accelerated demand growth and continued momentum despite facing supply chain challenges. Shares of the home furnishings provider rose 1.3% on the news in the extended trading session on September 8.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

RH reported adjusted earnings of $8.48 per share, up 73% year-over-year and significantly higher than analysts’ estimates of $6.44 per share. (See RH stock charts on TipRanks)

Net revenue climbed 39% compared to the year-ago period to $988.86 million and surpassed the Street’s estimate of $974.12 million.

Commenting on the company’s solid results, Gary Friedman, RH’s Chairman and CEO said, “An important point to consider when analyzing the strong demand in the housing market is the migration of consumers to larger suburban and second homes. This trend is resulting in substantial square footage growth that is driving increased furniture and furnishings demand. Add to that, historically low-interest rates, a record stock market and the reopening of several large parts of the economy, and elevated spending on the home could have a very long tail.”

Based on the continued momentum in business and powerful operating model, RH raised its Fiscal 2021 outlook. The company now forecasts full-year revenue to grow 31% – 33% annually and adjusted operating margin to increase 24.9% – 25.5% annually.

The company does however caution about the ongoing supply chain challenges due to the shut-down of manufacturing facilities in Vietnam. Moreover, shipping delays and higher transportation costs coupled with global price increases for the majority of its product categories have compelled RH to postpone the launch of a number of its ambitious projects to Fiscal 2022.

In response to RH’s stellar quarterly performance, Wells Fargo analyst Zachary Fadem lifted the price target on the stock to $800 (18.9% upside potential) from $725 while maintaining a Buy rating.

Fadem said, “While sticking points were few, supply chain challenges present incremental headwinds (via Vietnam factory shutdowns, slower transit times, etc.); but in our view, RH’s execution and innovation take the spotlight, with vendor relationships, pricing power, and luxury positioning providing offsets that most peers do not possess.”

The analyst believes that RH’s potential is still in the early stages and that it has a long-term growth story, having an innovative, multi-channel luxury brand with experience-focused design galleries, a member-based revenue model, and an emerging hospitality offering.

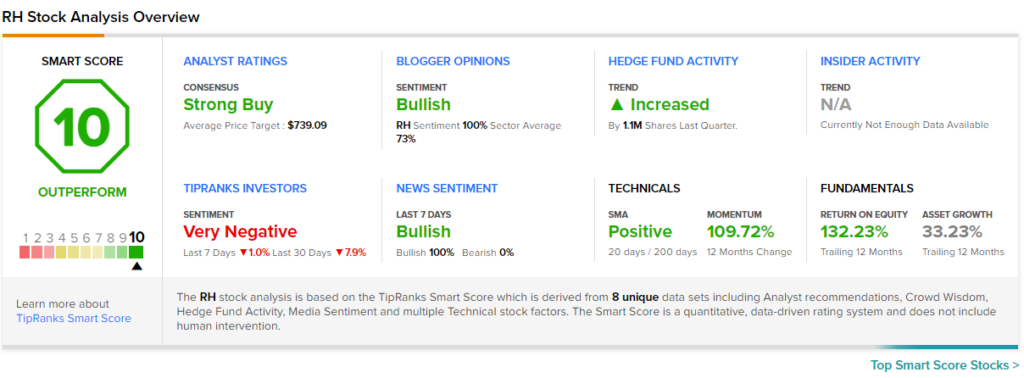

Overall, the stock commands a Strong Buy consensus rating based on 9 Buys and 3 Holds. The average RH price target of $739.09 implies 9.9% upside potential to current levels. Shares have gained 109.5% over the past year.

Furthermore, RH scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Coupa Software Soars on Topping Q2 Expectations, Gives Guidance

Callaway Golf Raises Q3, FY21 Guidance; Shares Jump 4%

Smartsheet Slips After-Hours Despite Exceeding Q2 Expectations