Shares of healthcare solutions provider Revvity (NYSE:RVTY) are under pressure in the pre-market session today after its third-quarter numbers lagged expectations. Revenue declined 5.8% year-over-year to $670.7 million, missing estimates by nearly $24.7 million. EPS of $1.18 also missed the cut by $0.01.

In the Life Sciences segment, revenue declined to $303 million, reflecting a 3% drop in organic revenue. Similarly, the Diagnostics segment experienced a 10% reduction in organic revenue, resulting in revenue of $363 million.

The decline in revenue, coupled with a drop in operating margin to 10.3% from 15.6% in the year-ago period, led to a significant decline in Revvity’s net income, which fell to $9.5 million from $85.3 year-over-year.

For Fiscal year 2023, Revvity now expects revenue to land between $2.72 billion and $2.74 billion. EPS for the year is anticipated to hover between $4.53 and $4.57. While the broader market environment remains difficult, Prahlad Singh, President and CEO of Revvity, commented, “During this period of increased market uncertainty, we will focus our efforts on those factors we can control to ensure the Company emerges from this period in an even stronger and more agile position.”

What Is the Stock Price Prediction for Revvity?

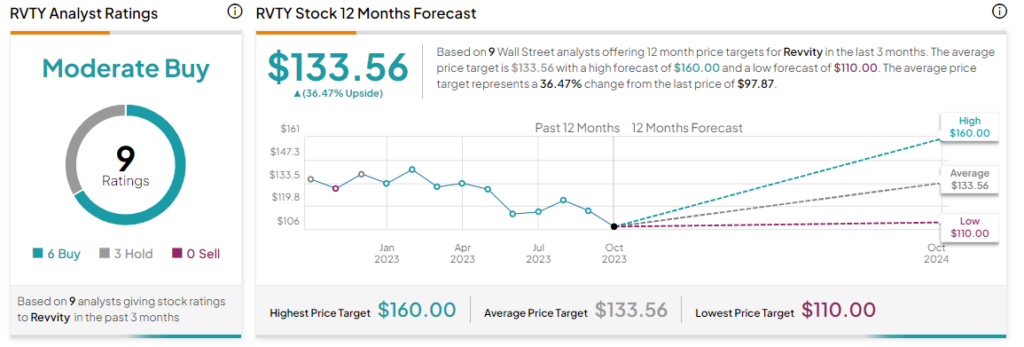

Overall, the Street has a Moderate Buy consensus rating on Revvity. The average RVTY price target of $133.56 implies a significant 36.5% potential upside. That’s after a nearly 27% drop in the share price over the past year.

Read full Disclosure