It seems that the New York-based cosmetics retailer Revlon (REV) is up for a roller-coaster ride.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Shares surged almost 60% on June 14 to close at $1.87 and were up another 10% during the pre-market trading session today at the time of writing.

This is in absolute contrast to its share price movement on June 10, when the stock collapsed to $2.05, losing half of its market capitalization in a single day after the Wall Street Journal reported that Revlon was on the verge of filing for Chapter 11 protection this week.

On June 13, it further lost another 50%, closing at its lowest ever at $1.17.

Why the Chapter 11 Filing?

According to the recent SEC filings, the company held over $3.3 billion in long-term debt at the end of March 31, which is over 11 times compared to its market cap of under $300 million last month.

According to the Wall Street Journal report at the start of the week, Revlon was holding talks with its lenders to extend its payment deadlines to avoid bankruptcy on debt of around $1.7 billion that will be due in September of 2023. Furthermore, half of Revlon’s total debt will be due for payment by 2024.

Earlier in January, ratings agency Moody’s downgraded Revlon to junk status. The agency stated that there was a high possibility of default based on nearly $2 billion in debt due in the next two years.

Wall Street’s Take

The stock has picked up a rating from one analyst in the past three months. Jefferies analyst Stephanie Wissink has a Hold rating on the stock with a price target of $8.50, with an upside potential of 299.06%.

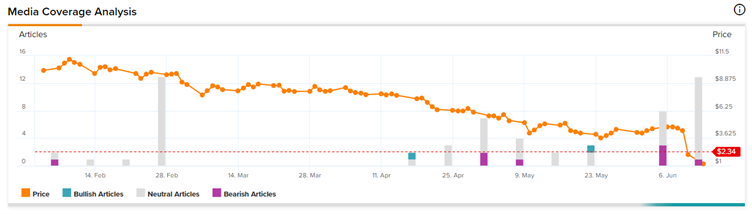

Negative News Sentiment

News sentiment for REV is Very Negative, based on 19 articles over the past seven days. None of the articles have Bullish sentiment, compared to a sector average of 60%.

Conclusion

Although the Securities and Exchange Commission has not received any formal notification from Revlon on the bankruptcy filing, there is huge speculation that it may be just around the corner.

Investors will wait and watch the turn of events in the coming days. In the meanwhile, REV has a short interest of over 35%, indicating bears are already in charge.