Rent-A-Center announced the acquisition of Acima Holdings for $1.65 billion. The omnichannel lease-to-own (LTO) provider said that the deal comprises of “$1.273 billion in cash and approximately 10.8 million shares of Rent-A-Center common stock currently valued at $377 million.”

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Rent-A-Center (RCII) said that it has obtained debt financing of $1.825 billion from J.P. Morgan Securities LLC, HSBC Securities (USA) Inc, and Credit Suisse for the transaction. The company expects the deal to close in the first half of 2021.

Rent-A-Center expects the Acima deal to enhance its “position as a premier fintech platform in both the traditional and virtual LTO segments.” Further, the combination of Rent-A-Center and Acima will bring meaningful synergies, the company said.

“We all share a common vision to expand the virtual LTO offering across a broader set of retail partners and to meet the needs of more customers through an integrated omnichannel strategy,” Rent-A-Center’s CEO Mitch Fadel said. “Acima will help us strengthen our organization, accelerate growth and increase our virtual partner base, allowing us to better serve more consumers with the flexibility of LTO.” (See RCII stock analysis on TipRanks).

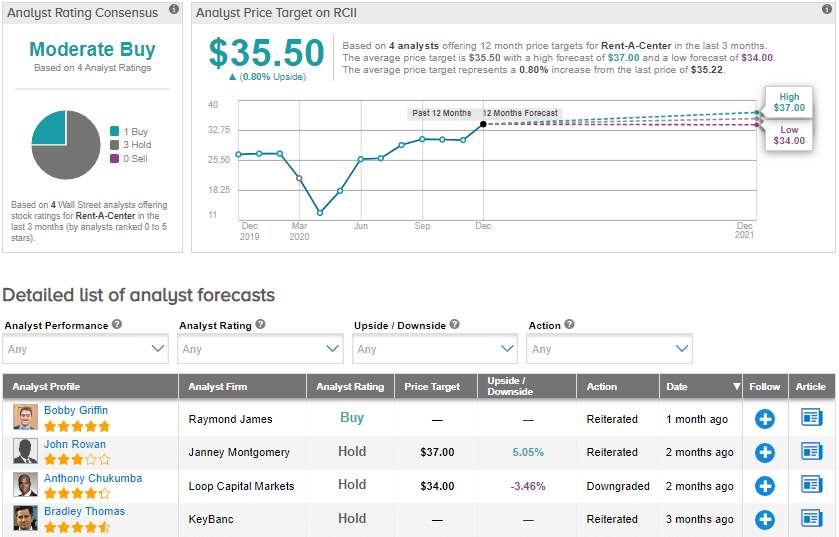

Following an investor meeting with the senior management, Raymond James analyst Bobby Griffin, on Nov. 13, maintained a Buy rating on the stock. Griffin continues to have a favorable outlook on the rent-to-own industry. The analyst is optimistic about “Rent-A-Center’s ability to continue to perform well during the COVID-19 recovery.”

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 1 Buy and 3 Holds. The average price target stands at $35.50 and implies that shares are almost fully priced at current levels. Shares have gained 22.1% year-to-date.

Related News:

Lockheed Martin Snaps Up Aerojet Rocketdyne For $4.4B; Street Sees 17% Upside

PPG To Snap Up Tikkurila In $1.35B Deal; Street Is Cautiously Optimistic

Blackstone In Talks To Merge Alight With Foley – Report