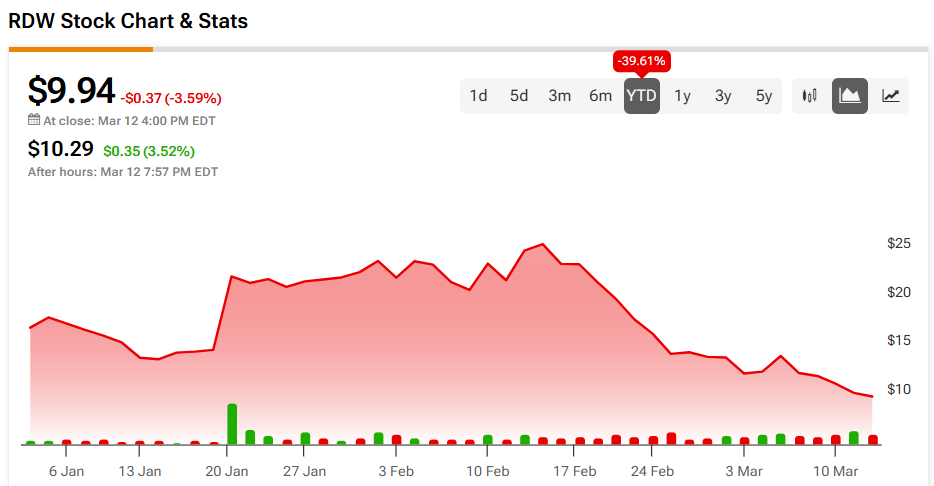

Redwire (RDW) released its Q4 and 2024 full-year financial results, with fourth-quarter revenue falling short of market expectations. Despite this, the company announced its intent to acquire Edge Autonomy and projected 2025 revenues to exceed consensus projections. Analysts maintain a bullish outlook on the company, even as the stock has shed roughly 40% of its value year-to-date.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Q4 Revenue Miss, but Strong Forward Guidance

Redwire produces mission-critical space solutions and high-reliability components in key areas such as solar power generation and in-space 3D printing and manufacturing. In recent developments, Redwire announced it has entered an agreement to acquire Edge Autonomy. The move aims to bolster Redwire’s market positioning, drive value by integrating Edge Autonomy’s capabilities into its operations, and expand Redwire’s service offerings in the space infrastructure sector.

Redwire’s fourth quarter 2024 revenues increased by 9.6% to $69.6 million from the same period in 2023, though missed market expectations by $4.99 million. The company reported a net loss of $67.2 million, primarily due to a $43.8 million non-cash loss resulting from increased private warrant liability.

The company closed 2024 with a reasonable financial position, reporting total liquidity of $64.1 million and a positive free cash flow of $3.0 million in the fourth quarter of 2024.

Looking ahead, Redwire predicts full-year revenue for 2025 to be between $535 million and $605 million, exceeding consensus projections of $459.06 million, with an adjusted EBITDA of $70 million to $105 million.

Analysts Are Bullish

Analysts following the company have remained primarily bullish on the stock. Despite less than stellar fourth-quarter results for 2024, H.C. Wainwright analyst Scott Buck recently reiterated a Buy rating on RDW stock, citing a combination of factors that he believes point to a promising future for Redwire, emphasizing the promising projections for 2025. He expects substantial revenue growth, bolstered by the acquisition of Edge Autonomy, along with a forecast of positive adjusted EBITDA and free cash flow.

Buck further pointed to expected increased defense spending by European countries as a key factor for future growth. His confidence in Redwire’s ability to meet its 2025 targets has led him to project a stock price target of $26.

Redwire is rated a Strong Buy overall, based on the recent recommendations of six analysts. The average price target for RDW stock is $25.00, which represents a potential upside of 151.51% from current levels.