It’s not an everyday occurrence to encounter a dividend stock that offers market-beating dividends that are safe and can also compound uninterrupted for decades straight. Growing its dividend for 30 consecutive years, Realty Income (O) is an attractive high-yield dividend play. After reviewing the net lease REIT’s recent financial results, I’m bullish on its stock for several reasons. These include operating as a leader in the highly fragmented net lease market, a strong balance sheet, a well-covered dividend, and an attractive valuation. This is why I’m starting coverage of Realty Income stock with a Buy rating.

Realty Income Had a Decent Third Quarter

Realty Income released what I thought were respectable third-quarter results on November 4, 2024, which is one reason for my bullish take on the stock. Thanks to the acquisition of Spirit Realty Capital closed in January, the net lease REIT’s total revenue rose 28.1% over the year-ago period to surpass $1.33 billion during the quarter. For perspective, that was much greater than the analyst consensus of $1.26 billion.

Realty Income’s adjusted funds from operations (AFFO) grew 2.9% over the year-ago period to $1.05 during the third quarter. The net lease REIT’s AFFO per share grew at a slower rate than revenue because of a 60-basis point contraction in the AFFO net margin to 68.8% from 69.4% in the prior-year quarter.

Ample Opportunities for Growth

Realty Income’s enterprise value of approximately $83 billion makes it one of the biggest net lease REITs in the world. This net lease REIT has plenty of catalysts to continue delivering annual AFFO per share growth of 4% to 5% as it has for decades. This is because Realty Income operates in what it estimates is a $5.4 trillion net lease addressable market in the U.S. and an $8.5 trillion addressable market in Europe. In the U.S., public net lease REITs aren’t even 4% of the addressable market. Meanwhile, in Europe, penetration is even lower, at much less than 1%. That gives Realty Income the ability to be selective with its acquisitions for quality purposes while also still moving the growth needle.

Realty Income’s business model is another growth driver. In exchange for capital that can be used to repay debt or expand the business, the net lease REIT’s clients agree to pay for property maintenance, insurance, and taxes, as well as a monthly rent check. These lease agreements also usually include annual rent escalators, which account for 1% to 2% annual AFFO per share growth.

As a result, the analyst consensus is that Realty Income’s AFFO per share will rise by 4.9% in 2024 to $4.20. For 2025, another 3.4% increase in AFFO per share to $4.34 is being anticipated. For 2026, an additional 4.1% growth in AFFO per share to $4.52 is the current consensus.

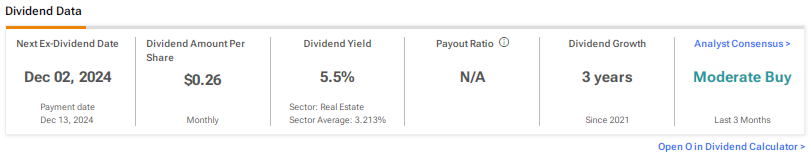

Realty Income Offers Amazing Dividend Consistency and an A-Rated Balance Sheet

As I alluded to at the outset, as an S&P 500 Index (SPX) component with at least 25 consecutive years of dividend growth, Realty Income is a Dividend Aristocrat. This is another reason that I like the stock. Realty Income’s 5.5% dividend yield is almost five times higher than the S&P 500 index’s 1.2% yield. This payout is also built on a firm foundation, with the payout ratio expected to be around 75% in 2024. That leaves Realty Income with enough capital to keep investing in acquisitions to fuel further AFFO per share growth. This is why I expect at least 3% to 4% annual dividend growth to be maintained in the years to come.

Realty Income’s financial positioning is another element that I like. That’s because the debt to total market cap ratio of 33% suggests the company is well-capitalized. Realty Income’s net debt to adjusted EBITDAre of 5.4x is an additional indication of its financial vigor. For these reasons, the net lease REIT possesses an A- credit rating from S&P Global (SPGI) on a stable outlook. This exceptional credit rating provides Realty Income with a low cost of capital, which provides it with more opportunities to invest in quality net lease properties at attractive investment spreads (acquisition cap rates minus the cost of capital).

Realty Income Shares Are Materially Undervalued

Realty Income’s valuation tells a different story from its fundamentals, which is a positive for my buy case. The net lease REIT’s price-to-AFFO ratio of 13.4x is below its 10-year normal P/AFFO ratio of 18.8.x The forward P/AFFO multiple of 13x is even cheaper. It’s true interest rates will probably come in a bit higher than the 10-year average, so that’s one factor that weighs on Realty Income’s valuation.

However, the company’s mid-single-digit annual AFFO per share growth points to a growth story that’s intact. This is why I believe that Realty Income is worth a P/AFFO multiple of at least 15 to 16x. That could offer a compelling upside from current levels.

Is Realty Income Stock a Buy, According to Analysts?

Turning to Wall Street, analysts have a Moderate Buy rating for Realty Income. Among 11 analysts, 3 have assigned Buy ratings and eight have assigned Hold ratings in the past three months. What’s more, the average 12-month price target of $64.45 indicates a 12.7% capital appreciation from the current share price.

Investment Summary

Realty Income is a well-known and trusted dividend payer. The company looks like it has room to keep growing its AFFO per share, which should support continued growth in its payout. Additionally, Realty Income’s valuation is arguably cheap enough that it could generate double-digit annual total returns for at least the next few years. That’s why I’m issuing a Buy rating.