Shares of Real Matters Inc (TSE: REAL) plunged ~6% in early trading Friday after the company posted a decline in profits and revenues in the first quarter. Real Matters provides services for the mortgage lending and insurance industries.

Revenues & Earnings

Real Matters’ consolidated revenues came in at $107.8 million in the quarter ended December 31, a decrease of 10.4% from $120.3 million in the first quarter of 2021.

Consolidated net revenue decreased by 34.7% to $28.8 million, and adjusted EBITDA decreased 66% year-over-year to $5.9 million.

Meanwhile, Q1 2022 profit was $2.6 million ($0.03 per diluted share), down 4.5% from $7.1 million ($0.08 per diluted share) in Q1 2021.

On an adjusted basis, Real Matters earned $3.5 million ($0.04 per diluted share) in the fourth quarter, down from $12 million ($0.14 per diluted share) a year ago.

In Q1 2022, Real Matters launched four new lenders and a new channel with one lender in U.S. Appraisal.

CEO Commentary

Real Matters CEO Brian Lang said, “Our Appraisal businesses performed well in the first quarter, and we were pleased with our competitive positioning in U.S. Title. We delivered strong progression on our scorecards in U.S. Title this quarter, which is laying the foundation for continued market share growth and strengthening our value proposition with prospective clients. We are on the right path to building market share in U.S. Title.”

Lang added that for the future, the company is focusing on performance, market share gains, and the launch of new customers. Its view of the long-term potential of the business is unchanged, and Real Matters remains confident in its objectives for Fiscal 2025.

Wall Street’s Take

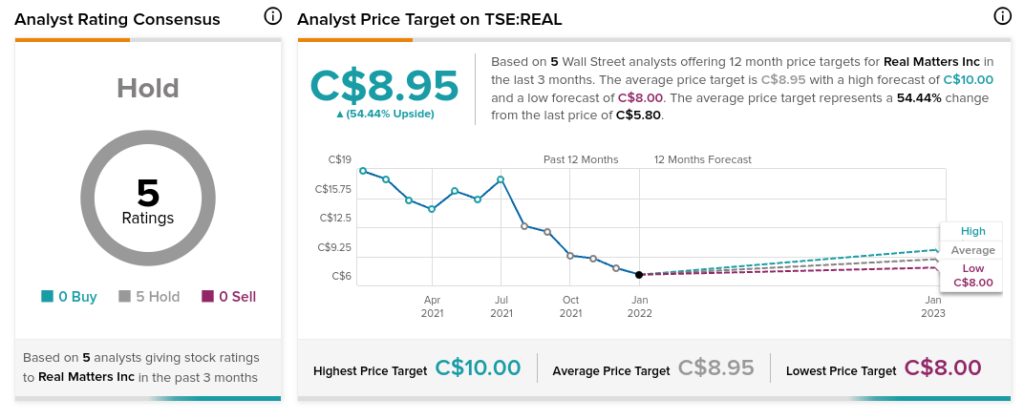

On January 25, Scotiabank analyst Paul Steep kept a Hold rating on REAL and lowered its price target to C$10 (from C$13). This implies ~70% upside potential.

Overall, the consensus on the Street is that REAL is a Hold based on five Holds. The average Real Matters price target of C$8.95 implies an upside potential of about 54% to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Related News:

The Real Brokerage Now Present in Ontario

Tricon Residential Launches Tricon Vantage