Reddit (RDDT) stock soared 24.8% in Tuesday’s extended trading session after beating Q3 FY24 expectations, giving healthy guidance, and turning a quarterly profit for the first time. Diluted earnings per share (EPS) of $0.16 exceeded the consensus loss estimate of $0.08. In the prior-year quarter, Reddit posted a diluted loss of 0.13 per share. Furthermore, revenue surged by an impressive 68% year-over-year to $348.35 million and beat the consensus of about $314 million.

Reddit is an open platform for sharing interests, ideas, opinions, and striking conversations. This is the social media platform’s third official quarterly results since it went public on March 21, 2024.

More on Reddit’s Q3 Results

Reddit’s robust results were attributed to a 47% year-over-year growth in Daily Active Uniques (DAUq), reaching 97.2 million. Also, the company reported its first-ever quarterly profit of $29.9 million, compared to a loss of $7.4 million in Q3 FY23.

Reddit has two sets of users on its platforms that it defines uniquely. Logged-in DAUq grew 27% to 44.1 million, while logged-out DAUq jumped 70% to 53.1 million. The logged-in users are usually the paid members and contribute more toward revenue, while the logged-out users are generally directed to Reddit through search engines and thus spend less time and are not monetizable. Reddit is determined to convert more of the logged-out users into logged-in users by offering a better platform experience.

Interestingly, Reddit’s ARPU (average revenue per DAUq) rose 14% to $3.58 compared to $3.14 reported in the year-ago period.

Reddit Gives Solid Guidance for Q4

Based on the ongoing momentum, Reddit gave solid guidance for the fourth quarter. Revenues are projected to reach between $385 million and $400 million, higher than the consensus. Adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) is forecasted in the range of $110 million to $125 million.

Is RDDT a Buy or Hold?

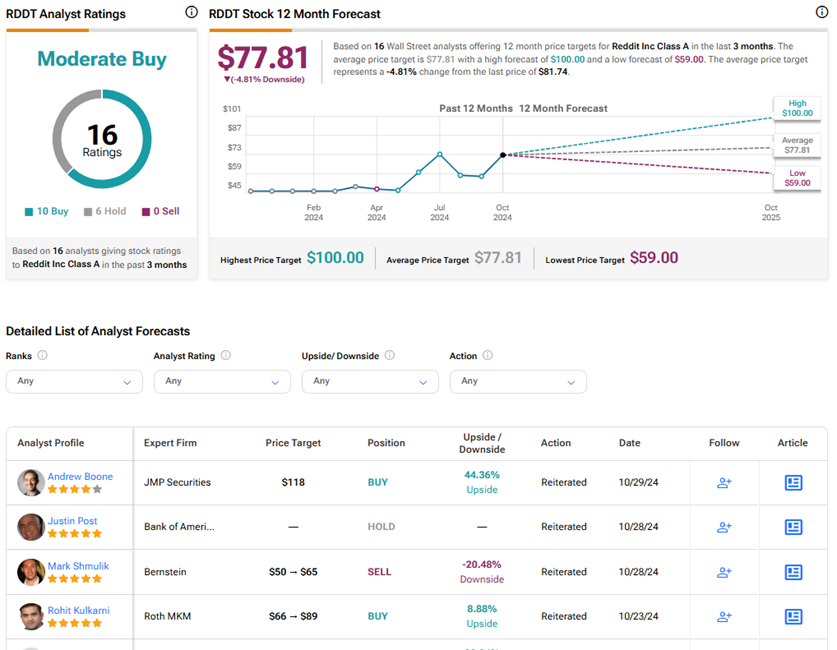

Wall Street remains divided on Reddit stock’s trajectory for now. On TipRanks, RDDT stock has a Moderate Buy consensus rating based on ten Buys versus six Hold ratings. The average Reddit Class A price target of $77.81 implies 4.8% downside potential from current levels. RDDT shares have gained nearly 77.7% since its initial listing in March.

Please note, all the ratings were given before Reddit reported stellar quarterly earnings. Analysts could change their recommendations on the stock after reviewing the latest results.