ESG (environmental, social, and governance) investing has been a hot trend for the past few years. However, this approach tends to exclude “sin stocks” such as alcohol, tobacco, firearms, and adult entertainment. Yet, studies have shown that sin stocks can beat the market. For instance, adult entertainment company RCI Hospitality Holdings (NASDAQ:RICK) has handily outperformed the S&P 500 (SPX) over the past five years (returning 125% versus 87% for the S&P).

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

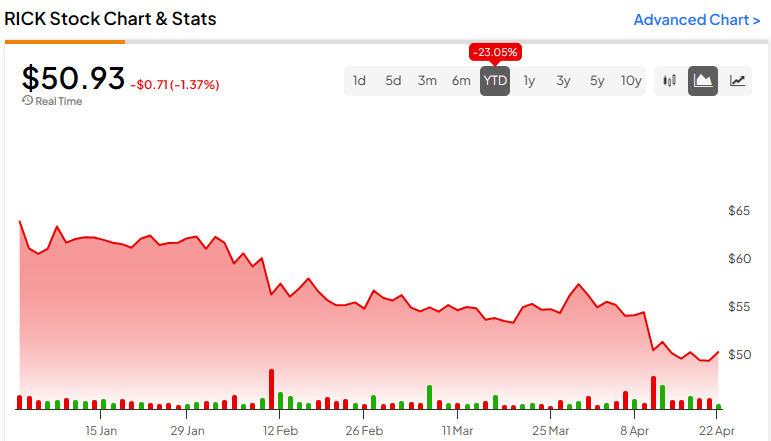

However, the stock is down 23% YTD and looks relatively undervalued, creating an opportunity for value investors willing to sin a little.

RICK’s Cabaret

RCI Hospitality Holdings is a holding company that offers adult entertainment and bar operations. The company operates via three main segments: Nightclubs, Bombshells Restaurants and Bars, and Digital Media. The Nightclub segment is primarily focused on adult entertainment clubs with major brands, including Rick’s Cabaret, Jaguar’s Club, Tootsie’s Cabaret, XTC Cabaret, and Club Onyx. Bombshells restaurants are located in the following major Texas cities: Dallas, Austin, and Houston.

Uniquely, RCI is the only publicly traded company in the U.S. that owns adult nightclubs. As a consolidator in a highly fragmented market, a crucial part of its business strategy involves acquiring or developing clubs or sports bars that exhibit potential for a minimum cash return of 25-33%.

The global adult entertainment market is expected to reach $76.5 billion by 2031, expanding at a CAGR of 6.69% during the forecast period.

RCI Hospitality’s Recent Financial Results

Between Fiscal 2018 and Fiscal 2023, the company experienced significant financial growth. Revenue increased at a compound annual growth rate (CAGR) of 12%, net income grew at a CAGR of 7%, and diluted earnings per share (EPS) rose at an 8% CAGR. This uptrend resulted in free cash flow increasing at an 18% CAGR, further fueling the firm’s ongoing acquisition strategy.

For the first quarter of Fiscal 2024, RCI Hospitality reported that total revenues rose by 5.6%, reaching $73.9 million, up from $70.0 million in the same period the previous year. However, EPS declined, coming in at $0.87 compared to $1.19 for the same period in Fiscal 2023.

Is RICK Stock a Buy, Hold, or Sell?

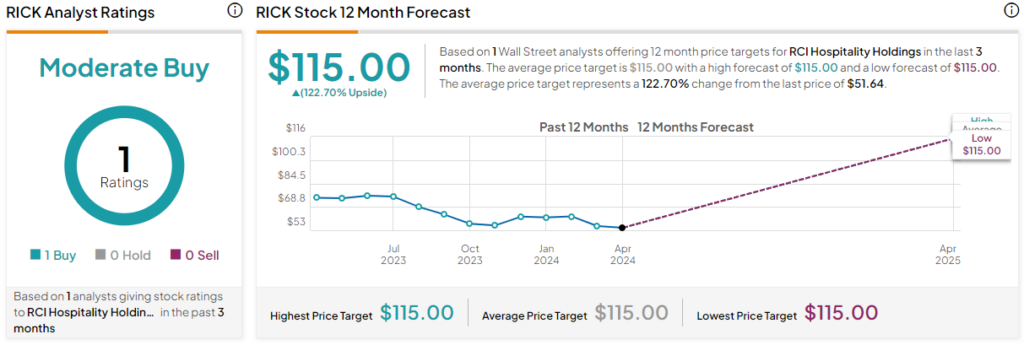

RCI Hospitality is thinly followed by Wall Street. However, analyst coverage has been bullish. For instance, H.C. Wainwright analyst Scott Buck recently issued a Buy rating on the stock, setting a price target of $115. He cites new locations coming online and the prospect of further expansion as drivers of growth to higher levels.

RCI is rated a Moderate Buy based on the most recent rating and 12-month price target. RICK stock’s price target of $115.00 represents 122.7% upside potential from current levels.

Despite a strong multi-year run, RICK stock has been trending downward this year, and it now trades at the low end of its 52-week price range of $49.37-$79.46. The slide in the stock price has driven it into relative value territory, with its P/S ratio of 1.6x comparing favorably to the restaurant industry average of 3x. Further, its EV/EBITDA multiple of 10.89x sits well below the industry average of 16.48x.

Final Thoughts on RICK Stock

RCI Hospitality Holdings is well-positioned to participate in the strong growth of the adult entertainment industry. The recent dip in the stock likely presents an attractive entry point for investors, and the stock’s blend of potential growth and value makes it a compelling option for those looking to add a little sin to their portfolios.