Roblox (NYSE:RBLX) crashed in trading after its Q1 revenues missed expectations and issued a downbeat second-quarter outlook. The video and mobile game developer generated Q1 revenues of $801.3 million, up by 22% year-over-year, but fell short of consensus estimates of $929.7 million.

Roblox reported a loss of $0.43 per share in the first quarter, compared to a loss of $0.44 per share in the same period last year. This loss was narrower than consensus estimates of a loss of $0.53 per share.

Roblox’s User Metrics

The company’s average daily active users were 77.7 million, up 17% year-over-year, while the average bookings per daily active user were $11.89, a growth of 2% year-over-year. Roblox kept its users engaged for 16.7 billion hours, a jump of 15% year-over-year.

The company defines bookings as revenue plus changes in deferred revenue and other non-cash adjustments during the period.

RBLX’s Q2 and FY24 Outlook

In the second quarter, RBLX expects to generate revenues between $855 million and $880 million, below Street estimates of $929.3 million. Bookings are estimated to be in the range of $870 million to $900 million, which falls short of consensus expectations of $943 million. Adjusted EBITDA in Q2 is likely to be between $36 million and $38 million.

Roblox warned that its cash flows will decline in Q2 due to the seasonality factor, as the Easter holiday occurred during the first quarter this year instead of the second quarter. The Easter holiday is a period of high user engagement for the company.

For FY24, the company has projected revenues in the range of $3.5 billion to $3.53 billion, with adjusted EBITDA estimated to be between $95 million and $147 million. Bookings are likely to be in the range of $4 billion to $4.1 billion.

Is RBLX a Good Stock to Buy?

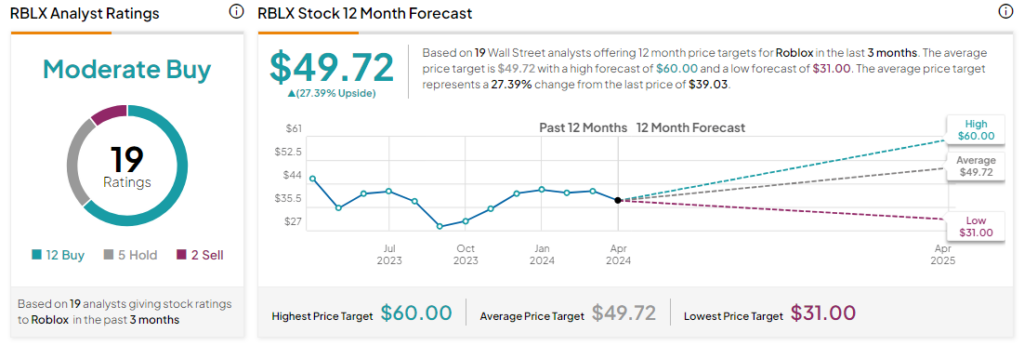

Analysts remain cautiously optimistic about RBLX stock, with a Moderate Buy consensus rating based on 12 Buys, five Holds, and two Sells. Year-to-date, RBLX has plunged by more than 10%, and the average RBLX price target of $49.72 implies an upside potential of 27.4% from current levels. These analyst ratings are likely to change following RBLX’s Q1 results today.