Wednesday turned out to be a particularly bad day for Enphase Energy (NASDAQ:ENPH). The stock plunged by ~15% during the session, hitting its lowest level this year after the company delivered an underwhelming Q3 report.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

In what represented the fifth quarter in a row of year-over-year sales declines, revenue reached 380.87 million, amounting to a 30.9% drop compared to 3Q23 and missing the Street’s forecast by $13.03 million. At the other end of the equation, adj. EPS of $0.65 fell shy of the consensus estimate by $0.13.

If that wasn’t bad enough, the company also offered a woeful outlook, expecting Q4 revenue will be in the range between $360-$400 million, some distance below analyst expectations of $433.5 million.

While there’s plenty for investors to be concerned about, Raymond James analyst Pavel Molchanov advises some perspective.

“While the 4Q guidance is less than we had anticipated, let’s keep in mind that it has been difficult to gauge the headwinds created by SunPower’s Chapter 11 filing this past August,” the analyst explained. “Management is cautiously optimistic about the European market recovering over the next 6 to 12 months, though it is a stretch for company-wide revenue to get back to pre-NEM 3.0 levels in 2025.”

For this year, Molchanov expects revenue to be down by 42%, with EPS showing a 48% decline. However, picking up from 2024’s weak base, for 2025, Molchanov sees revenue and EPS up by a respective 42% and 87%.

Molchanov also pointed out that Enphase’s geographic diversification, particularly in Europe’s energy transition, remains a key asset as the region pushes forward with climate initiatives and energy security needs.

So, what’s the takeaway for investors? Molchanov rates ENPH shares as Outperform (i.e. Buy) but lowered his price target from $140 to $130. Even with the adjustment, the stock still offers a potential 66% upside from current levels. (To watch Molchanov’s track record, click here)

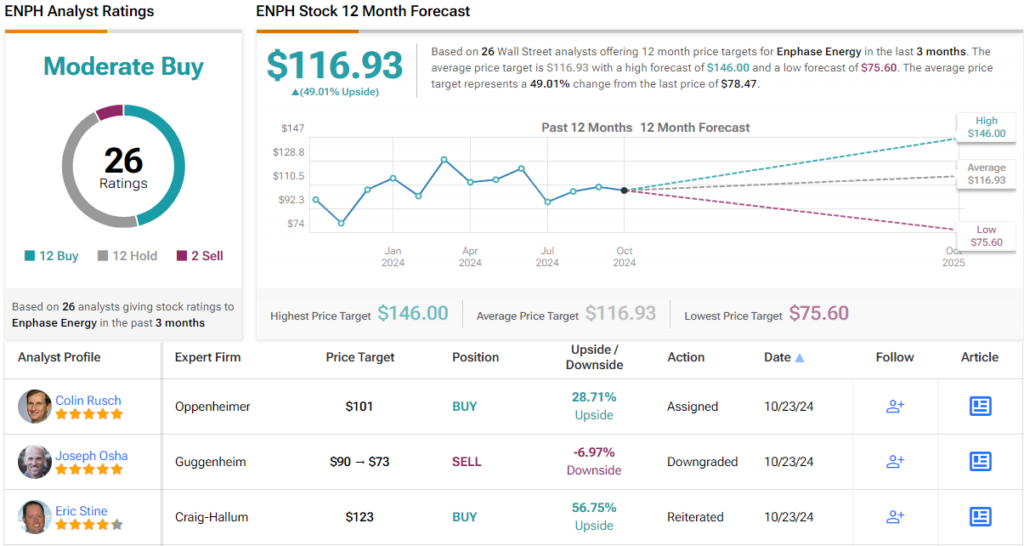

Overall, Wall Street is divided on Enphase, with 12 Buy recommendations, 12 Holds, and 2 Sells, resulting in a Moderate Buy consensus rating. There are nice gains projected here; the $116.93 average price target factors in 12-month returns of 49%. (See ENPH stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue