Fashion products company Ralph Lauren (RL) is narrowing its business focus as it pursues sustainable growth. The company said it will sell its Club Monaco brand to Regent, a private equity firm. Ralph Lauren’s stock rose 2.73% on Thursday.

The U.S.-based Ralph Lauren makes lifestyle products in categories such as apparel, footwear, and fragrances. It has a global footprint and targets the premium market.

Last year, the company announced a plan to reevaluate its brand portfolio. As part of that assessment, it decided to sell its Club Monaco business, which has been running for more than 20 years. Club Monaco operates a network of retail stores that sell high-end clothes.

Ralph Lauren did not reveal how much it is selling the business for. Instead, it said the transaction is expected to close by the end of June and that it believes the business will be in the right hands at Regent. It went on to state that Regent will bring its expertise in strategy and operations to ensure that Club Monaco continues to grow.

The sale of Club Monaco follows last year’s licensing of the Chaps brand. With these realignments, Ralph Lauren will narrow its focus to its core brands. (See Ralph Lauren stock analysis on TipRanks)

“As we increase our focus on our core namesake brands, we want to ensure the Club Monaco brand is also well-positioned for long-term success,” said Ralph Lauren CEO Patrice Louvet.

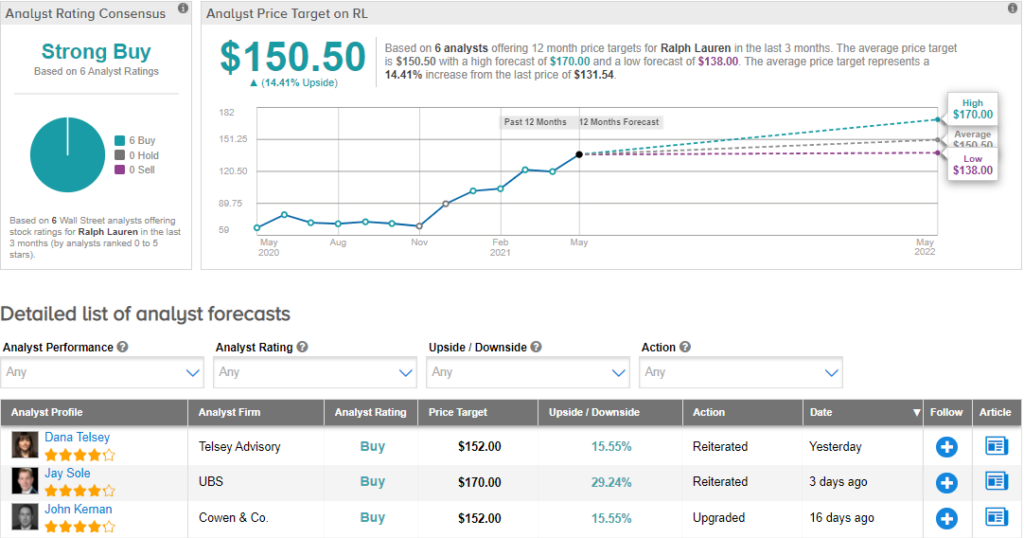

Cowen analyst John Kernan recently upgraded Ralph Lauren stock to a Buy from Hold. The analyst also raised the price target to $152 from $110. Kernan’s new price target implies 15.55% upside potential.

“Our field work combined with improving digital trends/checks suggest improving brand heat,” noted Kernan.

Consensus among analysts on Wall Street is a Strong Buy based on 6 unanimous Buy ratings. The average analyst price target of $150.50 points to 14.41% upside potential to current levels.

Related News:

Sonos Reports Profit and Boosts Outlook; Stock Jumps 7.43%

Amazon’s AWS Selected to Tackle NFL’s Quadrillion Schedule Options

Apple Strengthens Ties With Corning, Invests $45M