Electric vehicle (EV) battery technology is at a tipping point, with companies like QuantumScape (QS) at the forefront. The recent Q3 2024 earnings release sent the stock price soaring by over 18% as the company announced it had achieved a significant milestone in the production and shipment of its first anode-free, solid-state lithium-metal battery B-sample cells, the QSE-5, for automotive testing. Boasting 800 Wh/L energy density and ultra-fast charging capabilities, QuantumScape’s breakthrough has positioned it as a key player in the race to redefine the future of EV batteries.

A key element of its strategy is its collaboration with Volkswagen (VWAGY) subsidiary PowerCo to mass-produce the QSE-5 at a gigawatt-hour scale. This bolsters QuantumScape’s promise to deliver enhanced battery technologies to EV owners for improved safety, performance, and efficiencies in the very near future. This inflection point suggests the stock could see sustained upside, making it an intriguing option in the EV space.

QuantumScape Ramping Up Production

QuantumScape has primarily focused on developing and commercializing solid-state lithium-metal batteries for electric vehicles. The business has achieved a significant milestone by producing its first B Sample cells, the QSE-5, with an impressive energy density of 844 watt-hours per liter. These cells, the first-ever anode-free solid-state-lithium metal cell, can fast charge from 10% to 80% in approximately 12 minutes.

The company has commenced a collaborative partnership with PowerCo, Volkswagen Group’s battery manufacturer. This collaboration aims to mass-produce the QSE-5 technology platform on a gigawatt-hour scale. QuantumScape will grant PowerCo a production license for battery cells, with a $130 million prepayment in royalty payments upon satisfactory technical progress.

The partnership began in Q3, with joint development activities based in the company’s San Jose facility. It merged QuantumScape’s knowledge of solid-state battery technology and the QSE-5 platform with PowerCo’s expertise in scaling up high-volume manufacturing processes.

QuantumScape’s Recent Financial Results

The company recently reported Q3 financial results. Given the company’s focus on R&D, it reported capital expenditures of $17.9 million, primarily driven by supporting the low-volume QSE-5 prototype production and preparation for higher-volume production set for 2025. Q3 saw GAAP operating expenses and GAAP net loss at $130.2 million and $119.7 million, respectively, with an adjusted EBITDA loss of $71.6 million, consistent with forecasts. GAAP earnings per share (EPS) of -$0.23 aligned with analysts’ projections.

The firm remains on track with its full-year guidance for adjusted EBITDA loss, which has been narrowed to between $280 million and $300 million, leaning towards the higher end of the range. However, capital expenditure guidance for 2024 has been revised to between $60 million and $75 million due to efficiencies from the PowerCo deal and a rescheduling of certain payments from late 2024 to 2025.

The company closed Q3 with liquidity of $841 million. Its capital requirements continue to be shaped by its commercialization pathway, and QuantumScape believes its partnership with PowerCo provides a capital-efficient avenue to the market. The company projects its cash runway will extend into 2028, with potential additional funds, such as those raised under its ATM prospectus supplement, set to extend this runway further.

Is QS a Buy?

The stock has been volatile over the past few years, posting a beta of 2.48 as it declined from its meme stock-esque valuation of over $115 per share in late 2020. It trades at the lower end of its 52-week price range of $4.67 – $10.03, though thanks to the recent jump in share price, it now shows positive price momentum as it trades above all the major moving averages.

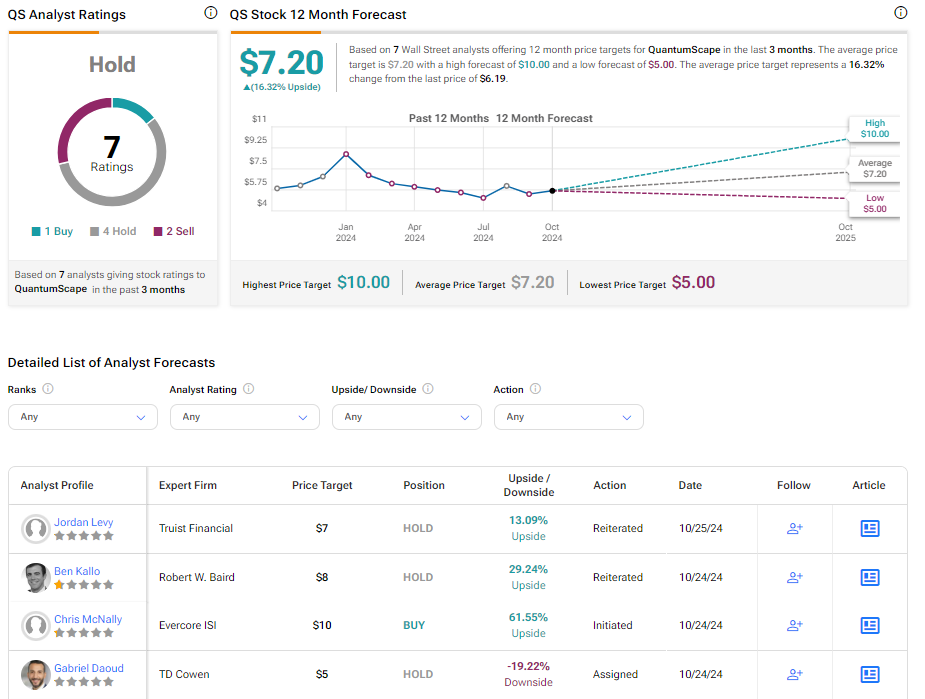

Analysts following the company have taken a cautious approach to QS stock. Despite the positive developments with its advancing battery technology, broader uncertainties in the EV market weigh heavily on the outlook for original equipment manufacturers (OEMs) in the space.

QuantumScape is rated a Hold overall, based on the aggregate of seven analysts’ recent recommendations. Their average price target for QS stock is $7.20, representing a potential upside of 16.32% from current levels.

Bottom Line on QuantumScape

QuantumScape’s recent electric vehicle (EV) battery technology achievements have made waves in the market. The success of its QSE-5 battery and its partnership with PowerCo to mass-produce the QSE-5 significantly boost QuantumScape’s growth potential. Given these developments, QuantumScape is a compelling investment option in the EV space that could see sustained upside.