Qualcomm (NASDAQ:QCOM) shares have been putting in an excellent performance this year, showing year-to-date gains of 44%, far exceeding the NASDAQ’s 12% returns.

According to Bank of America analyst Tal Liani, this outperformance is attributed to opportunities in computing, a rebound in China, and the potential of AI-equipped handsets.

Investors will be pleased to know Liani thinks there’s “further upside potential,” here, with the most “tangible opportunity” being Qualcomm’s entry into ARM-based consumer laptops.

Liani believes the semi giant is poised to benefit as the PC market transitions from x86 to ARM architectures. A significant factor here is Microsoft’s exclusive collaboration with Qualcomm to utilize its Snapdragon ARM chip for Copilot+ AI-powered PCs and tablets. “Conservatively,” opines Liani, “we see the key addressable market as ~60mn consumer laptops priced over >$1,000, a market we expect to ramp in 2025.”

In his projections for 2025, Liani envisions three scenarios: bear, base, and bull cases, with ARM models capturing 5%, 10%, and 15% market share, respectively. He anticipates a gradual increase of 1,000 basis points per year in 2026 and 2027. Given Qualcomm’s dominance in ARM-based processors, Liani suggests the company could grab a 70% share of this market.

Furthermore, Liani sees AI-embedded mobile phones as another promising avenue for growth. “The proliferation of AI may give rise to smartphones incorporating dedicated AI semiconductors,” Liani goes on to say. “While the cellular market is fully penetrated, with very minimal intrinsic growth, this could spark a handset refresh cycle – and present a big opportunity for Qualcomm.”

Lastly, a recovery in China could become another positive. The ongoing resurgence of the Chinese market, along with reported supply challenges at Huawei in the high-end segment, is a plus for Qualcomm. Chinese vendors contribute approximately 27% of its semis (QCT) revenue and around 44% of its licensing (QTL) revenue annually.

All the above merits a new price target, and a Street-high one at that. Liani’s price objective goes from $180 to $245, representing a one-year upside of 20% from current levels. Needless to say, Liani’s rating stays a Buy. (To watch Liani’s track record, click here)

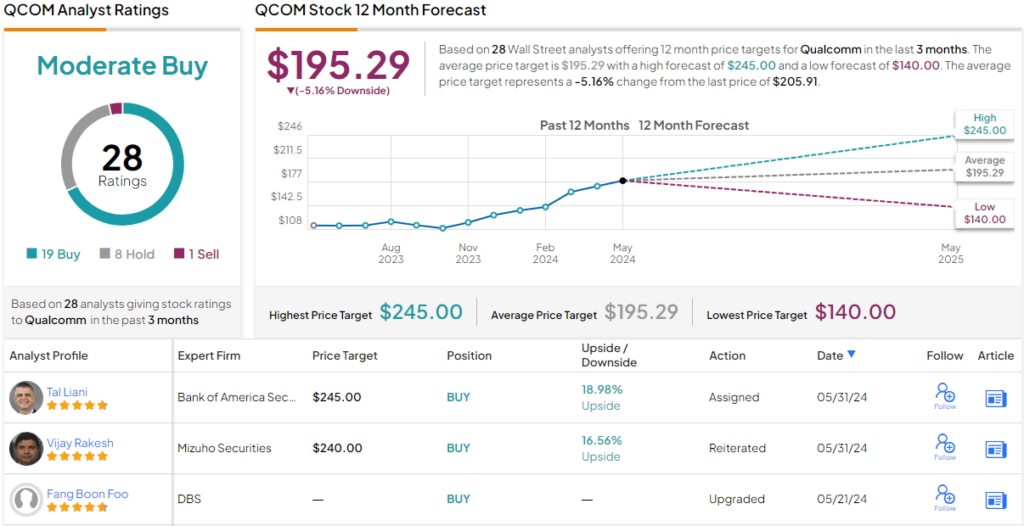

Most of Liani’s colleagues agree with his stance. QCOM stock claims a Moderate Buy consensus rating, based on 19 Buy recommendations, 8 Holds and 1 Sell. However, some think the shares have gained enough for now; at $195.29, the average target suggests the stock is overvalued by 5%. (See QCOM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Questions or Comments about the article? Write to editor@tipranks.com