Shares of Qualcomm (QCOM) rose in after-hours trading after the chipmaker won a legal battle against Arm Holdings (ARM), which had claimed that Qualcomm violated a licensing agreement tied to its $1.4 billion acquisition of chip startup Nuvia in 2021. According to Bloomberg, a Delaware jury ruled that Qualcomm didn’t breach Arm’s license terms when incorporating Nuvia’s technology into its own chips without paying a higher fee, although they were split on whether Nuvia itself had breached the agreement.

Tension has undoubtedly grown between the two longtime partners as Qualcomm pushes further into the computer processor market using Nuvia’s innovations. Arm argued that the license should have been renegotiated after the acquisition, while Qualcomm countered that its existing general license covered the designs.

Today’s outcome was important because major tech firms depend on Arm’s chip architecture, as it forms the backbone for the processors used in smartphones, computers, and vehicles. Additionally, Qualcomm, as one of its largest customers, provides a huge chunk of these processors to tech firms. Shares of Arm fell slightly in after-hours trading.

Which Stock Is the Better Buy, ARM or QCOM?

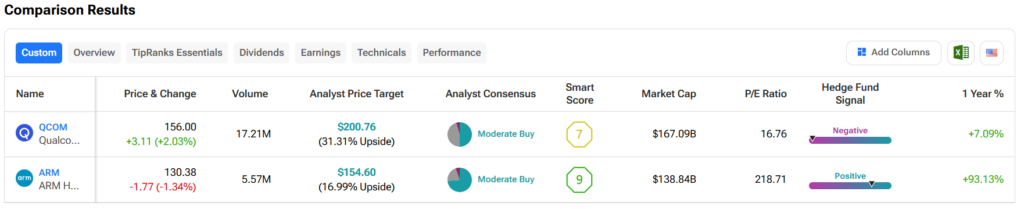

Turning to Wall Street, out of the two stocks mentioned above, analysts think that QCOM stock has more room to run than ARM. In fact, QCOM’s price target of $200.76 per share implies over 31% upside versus ARM’s 17%. Interestingly, though, institutional investors think differently. Indeed, TipRanks’ hedge fund signal shows that money managers have a negative view on QCOM but a positive view on ARM.

This is because hedge funds sold 13.4 million shares of QCOM during the previous quarter as its share price was falling. On the other hand, they bought 79,700 shares of ARM during the same timeframe. It will be interesting to see if these sentiments shift following today’s court decision.

Questions or Comments about the article? Write to editor@tipranks.com