Semiconductor company Qualcomm (QCOM) is scheduled to announce its results for the fourth quarter of Fiscal 2024 after the market closes on November 6. Analysts expect the company’s earnings per share (EPS) to rise about 27% year-over-year to $2.56 and revenue to increase about 15% to $10 billion.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

More on Qualcomm’s Upcoming Earnings

Qualcomm is expected to gain from the demand for its processors and modems in smartphones. Moreover, the company is optimistic about the demand for its automotive chips. In Q3 FY24, the company’s Handsets business saw a 12% rise in revenue to $5.9 billion, while the Automotive business reported an 87% increase in its revenue to $811 million.

Ahead of the Q4 results, Deutsche Bank analyst Ross Seymore reiterated a Hold rating on QCOM stock with a price target of $170. The analyst expects the company’s Q4 FY24 results to be in line with the Street’s estimates. He expects some volatility in the top line due to certain factors, including an additional week in the fiscal quarter and the absence of Huawei’s 4G revenue due to the sanctions imposed by the U.S.

Seymore feels that positives like QCOM’s initiatives to diversify its revenue streams by focusing on areas like the Automotive and AI PC sectors are already factored into the current stock price. While Seymore acknowledges Qualcomm’s strengths like solid execution and technological leadership, he prefers to stay on the sidelines due to the stock’s valuation.

Buzz Ahead of Qualcomm’s Earnings

Qualcomm has been in the news recently due to concerns about the impact of the cancellation of a crucial license by ARM Holdings (ARM) on the company’s business. The dispute started when Qualcomm acquired Nuvia, another ARM licensee, in 2021 and allegedly failed to renegotiate contract terms with ARM.

Reacting to the news, Citi analyst Christopher Danely believes that this dispute could probably go to the courts, and Qualcomm might end up paying ARM a higher royalty, which would weigh on its margins. While Danely doesn’t see any material impact, he thinks that this dispute might be dragged for a while, given previous court battles over royalties. Overall, Danely has a Hold rating on the stock due to softness in the wireless market.

Options Traders Anticipate a Notable Move After Earnings

TipRanks’ Options tool offers a quick way to gauge what options traders anticipate from the stock following its earnings report. The expected earnings move is calculated using the at-the-money straddle of the options set to expire closest to the announcement. While this may sound complex, the tool handles the calculations for you.

Currently, it indicates that options traders are predicting about an 8.3% swing in either direction in QCOM stock.

Is QCOM Stock a Buy, Sell, or Hold?

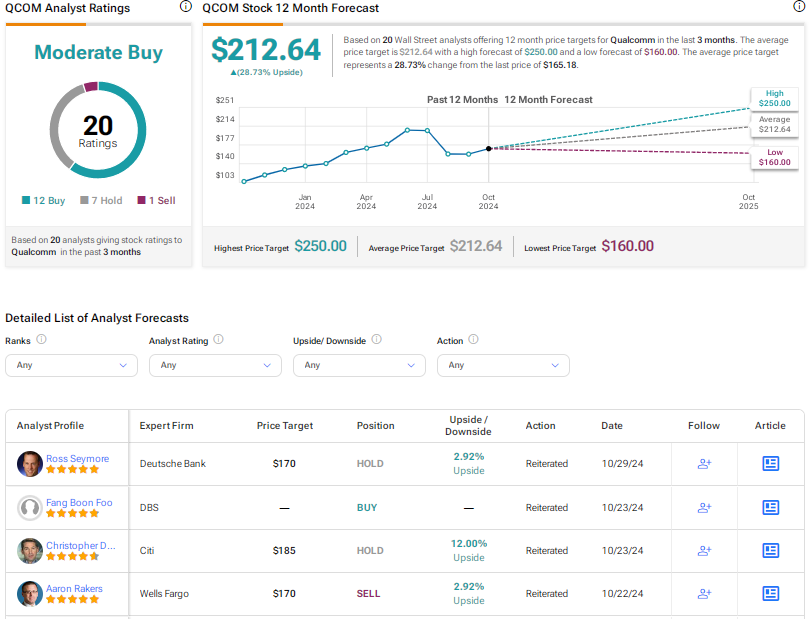

Wall Street is cautiously optimistic on Qualcomm stock, with a Moderate Buy consensus rating based on 12 Buys, seven Holds, and one Sell recommendation. The average QCOM stock price target of $212.64 implies about 29% upside potential from current levels. Shares have risen more than 14% so far this year.