Qualcomm Inc.’s (QCOM) shares spiked 12% in extended market trading after announcing a $1.8 billion settlement agreement with Huawei Technologies and providing its revenue outlook for the current quarter.

The stock surged to $103.83 in Wednesday’s after-hours trading as the world’s largest mobile chipmaker said it entered into a settlement agreement, as well as a new long-term, global multi-year patent license agreement with Huawei.

Under the terms of the agreement, which includes a license granting back rights to certain of Huawei’s patents, covering sales beginning Jan. 1, Qualcomm expects to generate an estimated $1.8 billion in revenues. The company is poised to record royalty revenue from Huawei starting in its fourth fiscal quarter.

Looking ahead, Qualcomm provided guidance for fourth-quarter adjusted revenue to be in a range of $5.5 billion and $6.3 billion, versus analysts’ estimates of $5.78 billion. EPS in the current quarter is forecast to be in a range of $1.05 to $1.25. The guidance includes an impact of greater than $0.25 reflecting the reduction in handset shipments as a result of COVID-19, including a partial impact from the delay of a 5G flagship phone launch, the company added.

“As 5G continues to roll out, we are realizing the benefits of the investments we have made in building the most extensive licensing program in mobile and are turning the technical challenges of 5G into leadership opportunities and commercial wins,” said Qualcomm CEO Steve Mollenkopf. “We delivered earnings above the high end of our range, continued to execute in our product and licensing businesses and entered into a new long-term patent license agreement with Huawei, all of which position us well for the balance of 2020 and beyond.”

Qualcomm said that during the third quarter of fiscal 2020, it returned $843 million to stockholders, including $733 million, or $0.65 per share, of cash dividends paid and $110 million through repurchases of 1.6 million shares of common stock.

Shares in Qualcomm have recouped all of this year’s earlier losses and are now up almost 6% year-to-date.

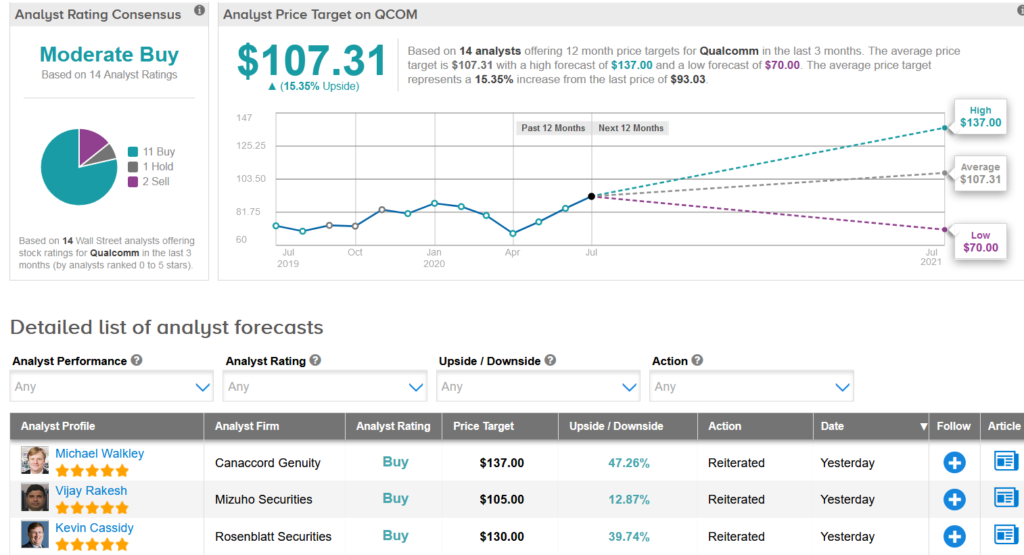

Following the news, five-star analyst Kevin Cassidy at Rosenblatt Securities raised the stock’s price target to $130 (40% upside potential) from $105 and recommended investors own QCOM as a “5G pure play”.

“In our view, management’s strategy is playing out very well despite the COVID-19 driven uncertainties,” Cassidy wrote in a note to investors. “Considering the 5G traction and the Huawei agreement, we consider [our] 18 multiple [valuation] as conservative.”

The rest of the Street is cautiously optimistic on the shares. The Moderate Buy analyst consensus is based on 11 Buys, 1 Hold and 2 Sells. Despite the recent rally, the $107.31 average price target implies 15% upside potential. (See Qualcomm stock analysis on TipRanks)

Related News:

Logitech Ramps Up Annual Profit Outlook As Q1 Income Leaps 75%

Synaptics Snaps Up DisplayLink For $305M In All-Cash Deal; Top Analyst Lifts PT

IBM Pops 5% in Extended Trading After Quarterly Profit Beats Expectations