Restaurant Brands (NYSE:QSR) (TSE:QSR) shares jumped by nearly 3% in the early trading session today after the quick-service restaurant company’s first-quarter top line surged by nearly 9.4% year-over-year to $1.74 billion. The figure exceeded expectations by roughly $50 million. Simultaneously, the EPS of $0.73 outpaced estimates by $0.01.

QSR’s Impressive Q1 Performance

The quarter was marked by impressive system-wide sales growth across Restaurant Brands’ segments. Notably, system-wide sales at Tim Hortons (TH) rose by 7.8% and at Popeyes Louisiana Kitchen (PLK) by 10.4%. Furthermore, system-wide sales in the company’s International operations jumped by 11.6%. The company’s consolidated system-wide sales rose by 8.1% and total consolidated comparable sales rose by 4.6%.

Additionally, QSR’s total system restaurant count during the quarter rose to 31,113, an increase of 1,157 over the comparable year-ago period. These gains translated into QSR’s adjusted operating income increasing by 7.7% to $540 million. The company had a net debt of $12.32 billion at the end of March 2024.

Furthermore, the company has announced a dividend of $0.58 per share. The QSR dividend is payable on July 5 to investors of record on June 21.

QSR’s Forward Guidance

Looking ahead, QSR is gunning for 3%+ growth in comparable sales and an 8%+ growth in its system-wide sales from 2024 to 2028. The company aims to increase in net restaurant count by 5%+ during this period.

What Is the Stock Price Forecast for QSR?

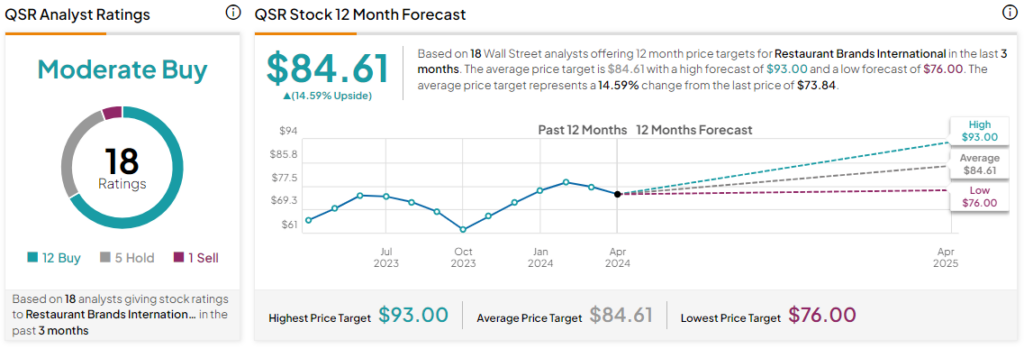

Today’s price gains come after a nearly 4.8% drop in Restaurant Brands’ share price so far this year. Overall, the Street has a Moderate Buy consensus rating on the stock, alongside an average QSR price target of $84.61. However, analysts’ views on the company could see changes following today’s earnings report.

Read full Disclosure