After the tech-heavy Nasdaq delivered a resounding 30.8% gain for 2024, many investors, including new investors or those who feel they missed the boat in 2024, are wondering if it’s too late to buy the top NASDAQ ETF, the Invesco QQQ Trust ETF (QQQ), in 2025.

While following up 2024’s massive gain with another massive return may be a tall order, it’s not too late to invest in a great ETF like QQQ. I’m bullish on the popular ETF based on its long track record of generating outstanding returns and its portfolio full of top tech and growth stocks that give investors exposure to many of the market’s most exciting long-term themes, whether it’s artificial intelligence, quantum computing, autonomous vehicles, or many others. Read on for more about this dynamic ETF!

What Is the QQQ ETF?

Launched in 1999, QQQ has grown into one of the market’s largest and most popular ETFs over the past 25 years. With over $320 million in assets under management (AUM), it is now the fifth-largest ETF in the market, with nearly double the assets of the sixth-largest ETF, the Vanguard Growth ETF (VUG).

QQQ simply invests in the Nasdaq-100, an index of the 100 largest non-financial companies listed on the Nasdaq exchange. As the Nasdaq is most often associated with technological innovation and growth, these 100 stocks include many of America’s best and brightest companies, as we’ll discuss in the next section.

What Stocks Does QQQ Own?

QQQ owns 101 stocks, and its top 10 holdings account for slightly over half (52.4%) of the fund.

Below, you can check out an overview of QQQ’s top 10 holdings using TipRanks’ holdings tool.

The nice thing about QQQ is that it gives holders diversified exposure to all long-term themes investors are excited about. There’s exposure to artificial intelligence through large positions in Nvidia (NVDA), Meta Platforms (META), Alphabet (GOOGL), and Palantir (PLTR), and semiconductors through Nvidia, Broadcom (AVGO), Advanced Micro Devices (AMD) and others.

The fund also exposes investors to autonomous vehicles, electric vehicles, and robotics, as shown by its position in Tesla (TSLA). QQQ even gives investors access to the potential of quantum computing through positions in Alphabet and Honeywell (HON). There is also plenty of exposure to cybersecurity, cloud, biotech, and essentially any other technological theme investors might be interested in. So, if you are looking for broad exposure to the technologies that will shape the future, QQQ is a good place to start.

Long History of Outperformance

Ultimately, you may be wondering if it’s now too late to invest in QQQ and all of the great stocks that it holds after its banner performance in 2024, which saw it generate an impressive total return of 25.6% (following up on a stellar 2023 return of 54.9%).

While it’s perhaps unrealistic to expect it to match its banner returns of 2023 and 2024, I don’t think it’s too late to buy the ETF and expect it to continue to perform strongly (if not quite as strongly as the last two years) simply because this strong performance is nothing new for QQQ — it’s part of a strong long-term trend.

In fact, QQQ has outperformed the market for many years, generating an excellent annualized return of 20.0% over the past five years. This strong performance eclipses that of the broader market. For example, the Vanguard S&P 500 ETF (VOO) posted an annualized return of 14.5% over the same time frame. Perhaps most impressively, QQQ’s sparkling return during this time period even accounts for a 32.6% loss in 2022 when tech and growth stocks pulled back sharply, showing that it can rebound from a drawdown and come back stronger than ever.

Looking out to the past decade, QQQ has generated a similarly impressive 18.3% annualized 10-year return. These returns also best those of the broader market, as VOO posted an annualized return of 13.1% over the same time frame.

Looking at the last 10 years from a cumulative perspective, an investor who put $10,000 into the QQQ ETF 10 years ago would have an investment worth an incredible $53,591 today based on QQQ’s cumulative 435.9% return over the past decade. An investor putting $10,000 into the S&P 500 at the same time would have about $24,254 today based on the S&P 500’s cumulative return of 242.5% over the same time frame.

The fact that QQQ has beaten the broader market over the past five and 10 years, periods that included a variety of market conditions, gives me confidence that this will continue to be a great long-term holding. While 2025’s returns may be lower than 2024’s, I expect the ETF to continue to perform well in the coming years.

Reasonable Cost

QQQ’s performance has been excellent, and investors don’t need to pay much to harness it for themselves. That’s because QQQ’s expense ratio of 0.20% means that an investor in the fund will pay just $20 in fees on a $10,000 investment annually, further adding to QQQ’s appeal.

Dividend

QQQ is also a dividend payer. Its yield of 0.56% is below that of the broader market (the S&P 500 currently yields 1.3%) but is still a nice bonus that helps to add to returns over time. Plus, it’s possible that this dividend can grow over time — QQQ has paid a dividend for 17 straight years and increased the size of its payout in each of the past three.

Is QQQ Stock a Buy, According to Analysts?

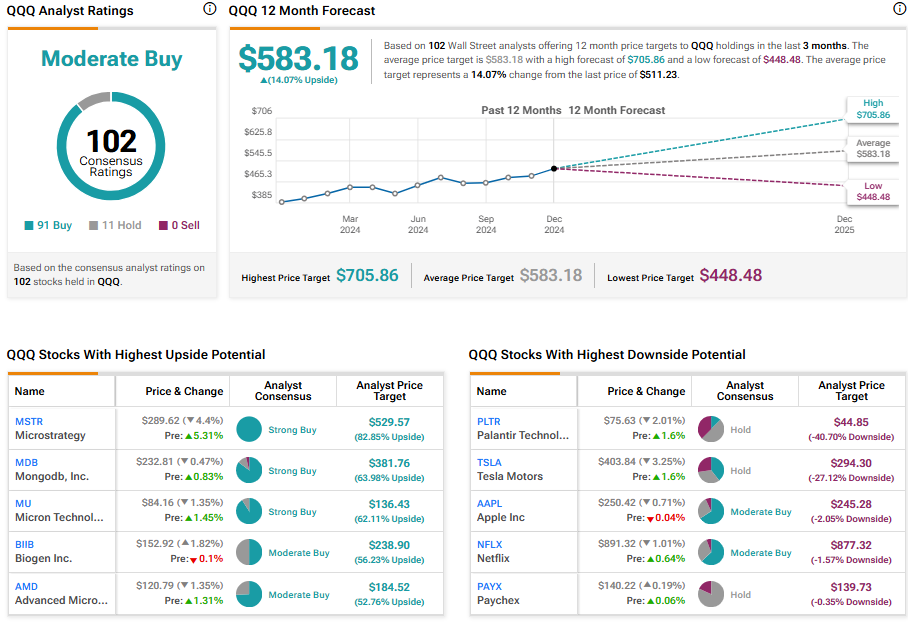

Turning to Wall Street, QQQ earns a Moderate Buy consensus rating based on 91 Buys, 11 Holds, and zero Sell ratings assigned in the past three months. The average analyst QQQ stock price target of $587.92 implies a 15.0% upside potential from current levels.

The Verdict: It’s Not too Late!

I’m bullish on QQQ based on its excellent performance history over the long term. While it’s understandable to be cautious after the fund’s incredible performance over the past two years, it’s important to remember that this performance wasn’t a flash in the pan, it’s part of a longer-term trend for this proven winner. QQQ has returned 20% per year over the past five years, and 18.3% per year over the past decade. Investors who allocated to QQQ five years ago have more than doubled their money, while investors who put their money into the fund 10 years ago have more than quadrupled their money.

It’s also worth remembering that QQQ’s best days could still be ahead of it. It gives investors diversified exposure to many of the U.S.’s best and most innovative companies and, thus, to many of the themes that should drive the market higher over the long term, including artificial intelligence, quantum computing, robotics, and more.

This combination of past performance and an exciting future means that QQQ will remain a top choice for investors in 2025 and beyond.