Pure Storage (NYSE:PSTG), a flash data storage hardware and software products company, slid in pre-market trading after the company’s guidance left investors disappointed. In the fourth quarter, the company expects revenues of $782 million, down 3.5% year-over-year but below consensus estimates of $919 million. The company anticipates adjusted operating income in Q4 of $150 million, falling short of analysts’ estimates of $199 million.

For FY24, Pure Storage has projected revenues of $2.82 billion, likely to be up by 2.5% year-over-year and below Street estimates of $919 million. The company expects an adjusted operating income of $450 million in FY24.

In the third quarter, the company generated revenues of $762.8 million, an increase of 13% year-over-year, and beat Street estimates of $761.5 million. PSTG reported adjusted earnings of $0.50 per share compared to $0.31 per share in the same period last year, surpassing consensus estimates of $0.40 per share.

Kevan Krysler, Pure Storage’s CFO commented, “We are pleased to see strengthening demand across our data storage platform, including the growth of our Evergreen//One Storage-as-a-Service offering, while also expanding our operating margin. Our business strategy continues to focus on continually increasing the value we provide to our customers including our consumption and subscription-based offerings.”

Is PSTG a Good Stock?

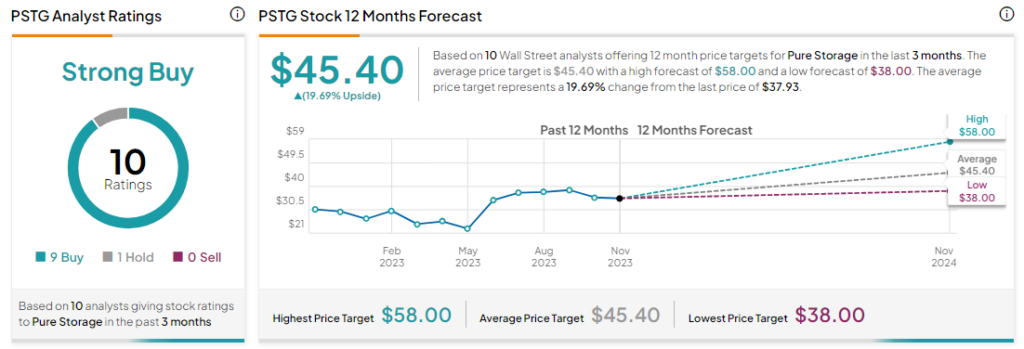

Analysts remain bullish about PSTG stock with a Strong Buy consensus rating based on nine Buys and one Hold. Year-to-date, PSTG stock has rallied by more than 35%, and the average PSTG price target of $45.40 implies an upside potential of 19.7% at current levels.