PTC Inc. has signed an agreement to buy Arena Solutions for $715 million in cash. The software company expects the deal to be completed in the second quarter of fiscal 2021 (ending in March 2021).

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

PTC (PTC) will finance the acquisition with cash and its existing credit facilities. Further, “the transaction is expected to be neutral to PTC’s FY’21 cash flow from operations target of $365 million and free cash flow target of $340 million (which reflects the deduction of approximately $25 million of capital expenditures from cash flow from operations) and accretive to FY’22 and beyond,” the company said.

PTC believes that the acquisition of Arena, which is a SaaS (software as a service) PLM (product lifecycle management) provider, will help the company expand its leadership position.

“This acquisition is the logical next step in PTC’s strategy to be the industrial SaaS leader,” PTC’s CEO Jim Heppelmann said. “A big first step was the acquisition of Onshape, the SaaS leader in CAD and collaborative design capabilities. Arena will enable us to round out the solution with full PLM capabilities and deliver the only complete CAD (computer-aided design) + PLM SaaS solution in the industry.” (See PTC stock analysis on TipRanks)

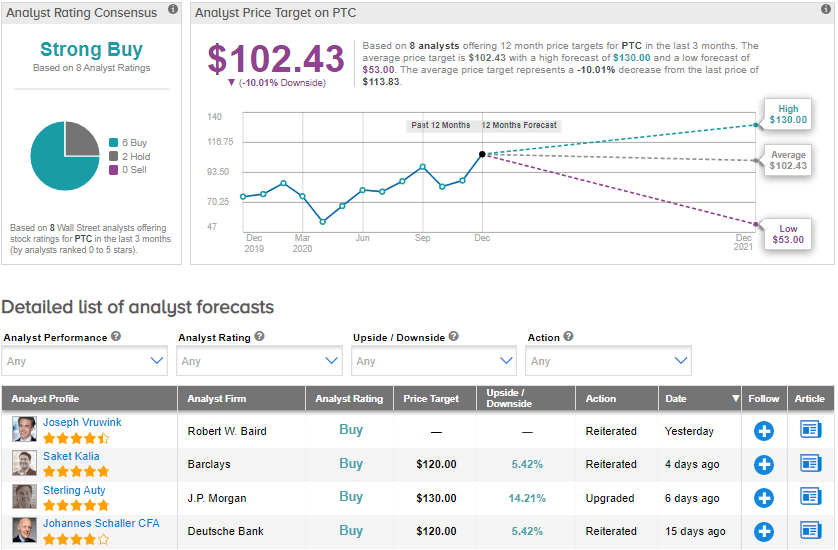

On Dec. 14, Robert W. Baird analyst Joseph Vruwink reiterated a Buy rating on the stock, as he is optimistic about the stock’s recent performance. The analyst noted that he would buy the stock in any “sell the news” reaction and expects cyclical tailwinds to drive the stock next year.

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 6 Buys and 2 Holds. With shares up 52% year-to-date, the average price target stands at $102.43 and implies downside potential of about 10% to current levels.

Related News:

Murphy To Buy QuickChek For $645M; Street Sees 6% Upside

JD Sports Buys Shoe Palace For $681M; Shares Jump 5%

Honeywell Snaps Up Australia’s Sine Group; Shares Up 20% YTD