Shares of Provention Bio nosedived 40.3% in pre-market trading on Friday as the biopharma company suffered a regulatory setback when the company received a notification from the US Food and Drug Administration (FDA) regarding its drug, teplizumab, used for the prevention or delay of clinical type 1 diabetes.

Provention Bio (PRVB) said that the FDA had “identified deficiencies that preclude discussion of labeling and post-marketing requirements/commitments at this time” in the review of PRVB’s Biologic License Application (BLA) for teplizumab.

Provention also said that FDA had reviewed the data regarding the drug comparability produced by its partner, AGC biologics, for the teplizumab BLA with a similar drug manufactured by Eli Lilly (LLY) and said that the data was not comparable and indicated that additional data would be required. This could result in a delay in Provention’s plans to commercialize teplizumab.

Provention Bio’s CEO and Co-Founder Ashleigh Palmer said, “While we believe the FDA’s initial feedback will likely result in a delay in timelines within which teplizumab has the potential to be approved by FDA and be made available for at-risk T1D patients, we believe in the comparability of the drug product produced by our partner AGC biologics with Eli Lilly manufactured product. We look forward to working closely with the Agency to address its additional data requirement, so we can deliver teplizumab to patients as soon as possible.”

“Additionally, we remain enthusiastic about the clinical efficacy and safety data submitted in connection with the BLA in support of teplizumab’s potential to address the high unmet needs of at-risk T1D patients and look forward to meeting with the FDA’s Advisory Committee and hearing from patients, KOLs [key opinion leaders] and other key stakeholders next month,” Palmer added.

The US FDA intends to conduct an Advisory Committee meeting on May 27 and will continue the review of clinical data submitted in Provention’s BLA application. (See Provention Bio stock analysis on TipRanks)

Following the announcement, Oppenheimer analyst Justin Kim lowered the price target from $29 to $18 and reiterated a Buy on the stock. Kim commented, “”Additional data” required for addressing the FDA’s raised issues will remain the focus as Provention approaches its May 27 AdCom. During the ongoing review period, we expect additional clarity on the scope of activities (and timeline to complete these objectives) that may be required to address the agency’s concerns. Prior to this clarity, we anticipate volatility for the shares.”

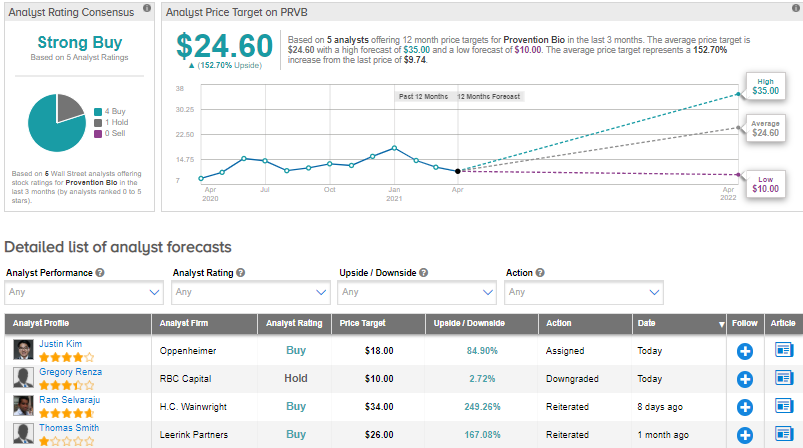

Overall, the rest of the Street is bullish on the stock in line with Kim’s view with a Strong Buy consensus rating based on 4 Buys and 1 Hold. The average analyst price target of $24.60 implies that PRVB shares have 152.7% upside potential to current levels.

Related News:

Tyson Foods Officially Opens New $425M Tennessee Poultry Complex

Levi’s 1Q Sales And EPS Beat Estimates; Street Says Buy

Costco’s Comps Climb 11.1% In March

Questions or Comments about the article? Write to editor@tipranks.com