Prologis, Inc. (PLD) reported stronger-than-expected Q2 results driven by strong demand for logistics space and all-time low vacancies. Shares of the global industrial real estate investment trust (REIT) have gained 34% over the past year.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company reported Q2 revenues of $1.15 billion, beating analysts’ expectations of $1.02 billion. (See PLD stock charts on TipRanks)

Meanwhile, earnings per share came in at $0.81, versus $0.54 recorded in the prior-year quarter. The company reported Q2 Funds from Operations (FFO) of 1.01 per share versus FFO of $1.11 per share in the prior-year period.

While total revenues fell from $1.27 billion in the year-ago quarter, rental revenues came in at $1.02 billion, up from $945 million in the prior-year quarter.

Based on robust Q2 results, the company raised its guidance for Fiscal 2021 and now forecasts net earnings in the range of $3.08 – $3.14 per share, compared to the previously guided range of $2.80 – $2.90.

The REIT also forecasts core FFO in the range of $4.04 – $4.08 per share versus previous guidance of $3.96- $4.02 per share.

Prologis CFO Thomas S. Olinger commented, “Our outlook is equally promising, supported by our in-place-to-market spread of nearly 17 percent; a land portfolio with a build-out potential of about $18 billion; and an industry-leading balance sheet.”

Following the strong Q2 results, Wells Fargo analyst Blaine Heck reiterated a Buy rating on the stock.

Heck favors Prologis over its competitors based on the company’s FFO beat, impressive leasing metrics, and enhanced same-store growth.

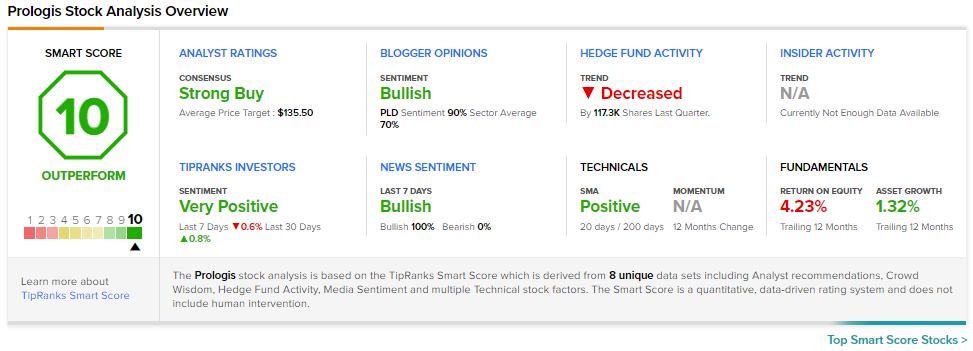

Consensus among analysts is a Strong Buy based on 9 Buys and 1 Hold. The average PLD price target of $135.50 implies 6.9% upside potential from current levels.

PLD scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

State Street Posts Upbeat Q2 Results, Shares Leap 2.9%

Autoliv Misses Q2 Estimates, Shares Plunge 4.8%

KKR to Create Colombia’s First Digital Infrastructure Company with Telefónica