The CEO of China-based EV maker Xpeng, Inc. (NYSE: XPEV), He Xiaopeng, said if auto suppliers in Shanghai and nearby areas do not resume work then local carmakers may have to stop production next month, according to a report published by Reuters.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

“Growing lockdowns to stop the spread of COVID-19 in China are clogging highways and ports and shutting countless factories – disruptions that are rippling through global supply chains for goods ranging from electric vehicles to iPhones,” Xiaopeng said.

Calculations by Reuters show that Tesla (NASDAQ: TSLA) has suffered an output loss of over 40,000 units since it halted production at its Shanghai facility on March 28. People with knowledge of the matter said that the EV giant’s Shanghai manufacturing plant produces 6,000 units of Model 3 and 10,000 units of Model Y per week.

About Xpeng

Based out of Guangzhou, XPeng designs, develops, manufactures, and sells smart EVs mainly in China. It also offers an autonomous driving software system, bank loans, vehicle leasing, and auto insurance services.

At the time of writing, XPEV stock was trading 4.4% down on Monday.

Analyst’s Take

Earlier this month, UBS (NYSE: UBS) analyst Paul Gong maintained a Hold rating on the stock and lowered the price target to $34 from $48 (32.3% upside potential).

The analyst said, “With battery price increasing RMB 200-300/kWh versus 2021, our estimation shows battery cost accounts for 30% of XPeng cars, versus 20% for Nio (NYSE: NIO) and 12% on Li Auto (NASDAQ: LI). We think passing on cost inflation to price-sensitive customers may have adverse consequences for new orders.”

Overall, the stock has a Strong Buy consensus rating based on nine Buys and one Hold. XPEV’s average price target of $45.16 implies 75.5% upside potential. The stock has lost 46.4% year-to-date.

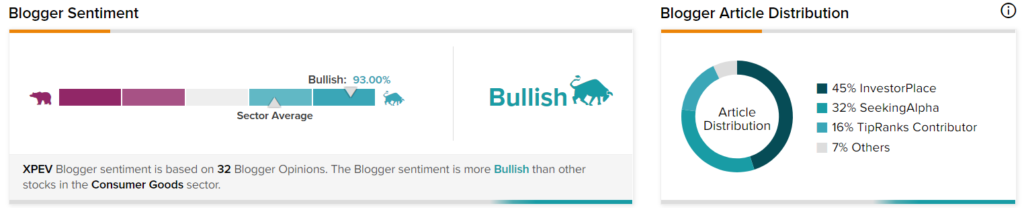

Blogger Opinions

TipRanks data shows that financial blogger opinions are 93% Bullish on XPeng, compared to the sector average of 68%.

Conclusion

The stoppage of work at the factories of Chinese auto suppliers has the potential to impact the supply chain and the production of vehicles. This will hurt carmakers who are already struggling to deal with the supply chain disruption caused by the Russia-Ukraine conflict.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Mercedes-Benz Sets New Record

Volta Posts Mixed Q4 Results

What Does Stellantis-Qualcomm Deal Mean for Maserati?