Procore Technologies (PCOR), a global cloud-based construction management software provider, has posted Q3 performance that exceeded expectations. The company recorded a 94% gross revenue retention rate and a significant year-over-year increase in organic customer contributions. With its successful expansion to the UK, Australia, and New Zealand, Procore continues to strengthen its capabilities and satisfy regional needs. Looking ahead, Procore expects continued growth, forecasting an 11% year-over-year revenue increase by 2025, making it a potentially attractive option for investors seeking long-term capital appreciation.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Procore’s Strategic Shift Paying Dividends

Procore Technologies is a California-based company and a leading provider of construction management software. It offers a cloud-based platform and related products.

Procore has evolved its go-to-market strategy. The first strategy involves implementing a general manager model to localize its approach and enhance service to regional markets. The second strategy involves introducing new technical roles that aim to support all buyer personas and maximize the value of the Procore platform. The company believes these developments will make it a multibillion-dollar revenue company while fostering long-lasting customer partnerships.

Procore has made considerable progress. In the third quarter, it achieved a gross revenue retention rate of 94% and an 18% year-over-year increase in organic customers contributing over $100,000 of annual recurring revenue, totaling 2,261. The period also saw the addition of 225 net new organic customers, bringing the total to 16,975. Additionally, Procore announced it would expand its upcoming Procore Zones to the UK, Australia, and New Zealand to offer customers the flexibility to control data storage and management within their regions.

Procore’s Recent Financial Results & Outlook

The company has recently released results for the third quarter of 2024. Revenue increased 19% year-over-year to $296 million, beating analysts’ estimates by $8.41 million. Gross margins were 81% and 85% for GAAP and non-GAAP, respectively. While the GAAP operating margin was reported at -12%, the non-GAAP operating margin clocked in at 9%. Notably, the company also reported an operating and free cash inflow for the third quarter of $39 million and $23 million, respectively. Non-GAAP earnings per share (EPS) of $0.24 exceeded the consensus estimate by $0.02.

Following the Q3 earnings report, PCOR’s management has issued forward-looking guidance for Q4 2024, full-year 2024, and 2025, expecting marked improvements in key financial indicators. In Q4 2024, revenue is projected to be $296 to $298 million, representing a year-over-year growth of 14% to 15%. The non-GAAP operating margin is estimated to be between 3% and 4%.

For the entire year of 2024, Procore anticipates revenues between $1.146 billion and $1.148 billion, an annual growth rate of 21%. The non-GAAP operating margin is expected to be between 10.5% and 11%. Looking ahead to 2025, the company forecasts revenues of at least $1.275 billion, which would equate to an annual growth rate of 11%. The non-GAAP operating margin is expected to further improve to 13%.

Is PCOR a Buy?

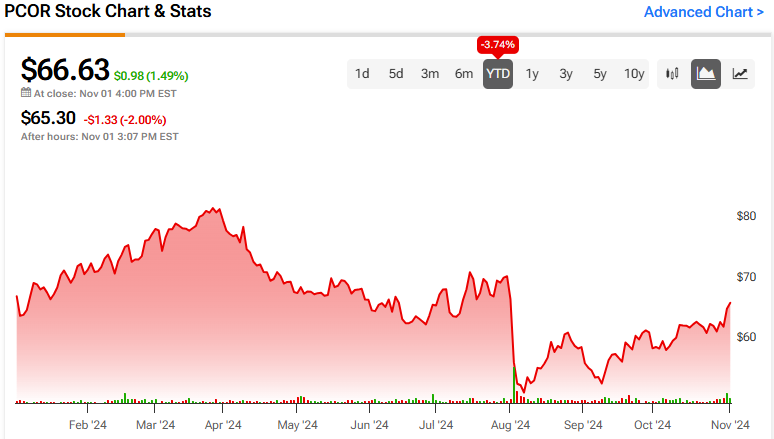

After a 25% drop in early August, the stock has clawed back most of the decline by posting a 25% gain over the past three months, bringing it to a slight loss of -3.75% year-to-date. It trades near the middle of its 52-week price range of $48.11 – $83.35 and shows ongoing positive price momentum as it trades above the 20-day (61.70) and 50-day (61.01) moving averages. Its P/S ratio of 8.77x sits at a slight premium above the Application Software industry average of 6.8x.

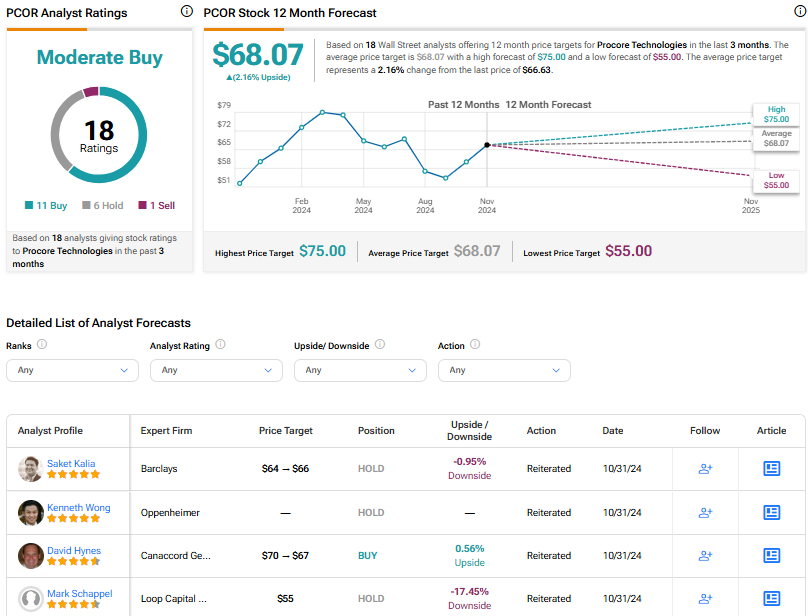

Analysts following the company have been cautiously optimistic about PCOR stock. For example, Canaccord has revised the share price target from $70 to $67 while maintaining a Buy rating. Conversely, Barclays increased its price target to $66 from $64, keeping an Equal Weight rating on Procore shares. This was driven by the Fiscal 2025 forecast of 11% year-over-year revenue growth and 13% operating margin. Meanwhile, JMP Securities reduced its price target from $82 to $75 despite better-than-expected Q3 results.

Procore Technologies is rated a Moderate Buy overall, based on the most recent recommendations of 18 analysts. Their average price target for PCOR stock is $68.07, representing a potential upside of 2.16% from current levels.

Final Analysis on PCOR

Procore continues demonstrating strong financial performance, surpassing Q3 expectations with notable growth in organic customer contributions. This success is attributed to the company’s strategic shift to a localized approach and tailored services to buyer personas. Backed by its planned expansion to the UK, Australia, and New Zealand, Procore forecasts an 11% annual revenue increase by 2025, making this a promising prospect for investors eyeing long-term capital growth.