One of the new phrases that seems to be paying some dividends—at least for certain political parties—is the notion of “price-gouging.” This means that, somehow, the high prices we see at the stores for virtually everything these days are not the result of mismanaged government monetary policies but rather greedy businesses trying to overcharge people. However, this is not what is happening at retail giant Target (TGT), noted its CEO. This commentary, along with TGT’s earnings report, caused shares to soar in today’s trading.

Basically, Target CEO Brian Cornell said there was pretty much no way that businesses could be price gouging, especially not Target, given the sheer competitive nature of the retail landscape right now. And this makes sense; with consumers pulling in their wallets ahead of what they figure will be a recession to come—if it isn’t already here—the retail market has to do what it can to draw customers, not keep them away by deliberately inflating prices.

Cornell noted that Target is in a “penny business,” where profit margins are already remarkably small, and only volume can produce significant results. Thus, Target is frantically trying to appeal to customers’ frugality and need for value. There just isn’t room for price-gouging in an environment where customers are acutely sensitive to prices.

Has Target Beaten Theft, Too?

Meanwhile, inventory shrink—the term for things like shoplifting and other theft—is still a problem for retailers, and more so in some places than others. But reports note that Target’s approach seems to be working, and limiting the amount of stuff that can be stolen.

One of the biggest moves that seems to have helped is the expansion of locked cases. While this tactic has had mixed results—customers aren’t particularly interested in having their chosen items locked away and waiting several minutes for an underpaid teenager to come over and unlock the case—it has certainly had an impact on theft.

Is Target a Good Stock to Buy Right Now?

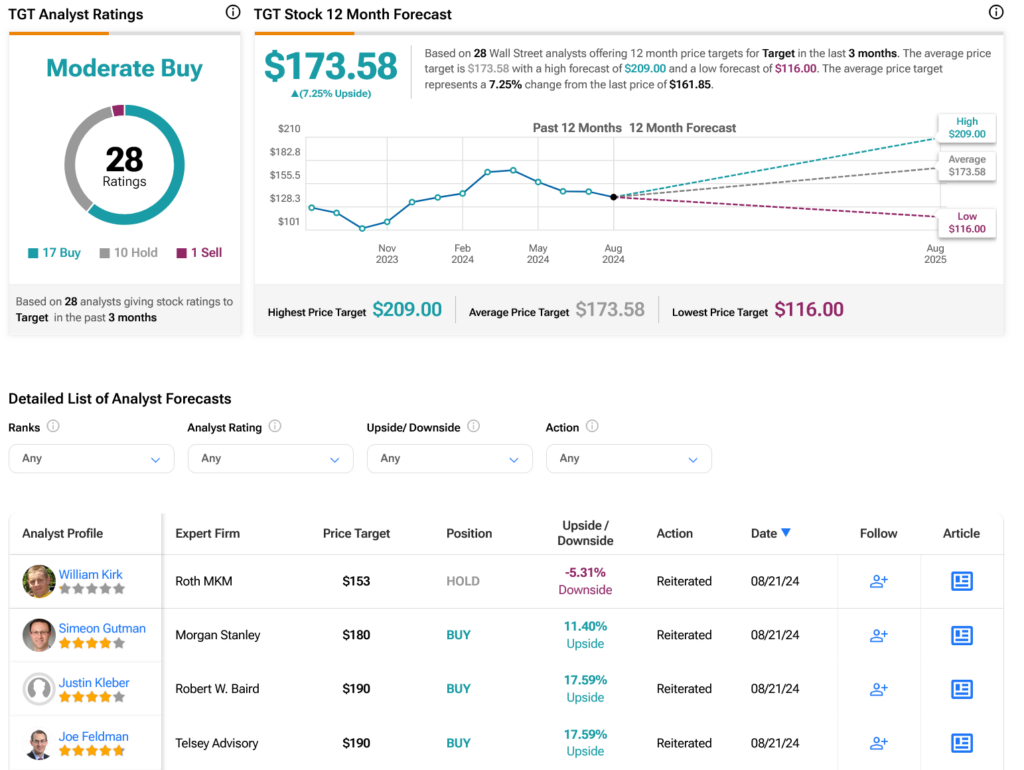

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TGT stock based on 17 Buys, 10 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 32.54% rally in its share price over the past year, the average TGT price target of $173.58 per share implies 7.25% upside potential.