Paints, coatings and specialty materials supplier PPG Industries, Inc. (PPG) has reported better-than-expected results for the third quarter ended September 30, 2021. The robust results can be attributed mainly to the growth witnessed in net sales.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Following the news, shares of the company declined 1.5% to close at $158.10 in Wednesday’s extended trading session.

PPG Industries reported quarterly net sales of $4.4 billion, up 18.6% year-over-year. The figure surpassed the Street’s estimate of $4.24 billion. The growth in net sales was driven by a 23% year-over-year rise witnessed in net sales from the Performance Coatings segment to $2.8 billion. The segment represented about 63.1% of the quarterly net sales of the company.

Meanwhile, revenue growth in the Industrial Coatings segment also contributed to the overall net sales growth. The segment reported a rise of 13% in net sales from the prior year.

The company reported quarterly earnings per share (EPS) of $1.69, a decline of 17% from the year-ago period. However, the figure surpassed the consensus estimate of $1.61.

In other key metrics, the company reported cash and short-term investments of about $1.3 billion and net debt of $5.5 billion.

Notably, the company also provided guidance for 2021. It expects EPS for the year to be between $6.67 and $6.73. The consensus for the same is pegged at $7.03.

The CEO of PPG Industries, Michael H. McGarry, said, “As we communicated in early September, supply-chain disruptions worsened during the quarter as various commodity and component shortages restricted both our manufacturing output and that of certain customers. Several of our businesses, including automotive refinish, protective and marine, and packaging coatings delivered above-market volume performance despite the procurement challenges. In addition, demand recovery continued in our aerospace coatings business, primarily in the aftermarket.” (See PPG stock chart on TipRanks)

See Insiders’ Hot Stocks on TipRanks >>

Last month, Robert W. Baird analyst Ghansham Panjabi reiterated a Buy rating on the stock with a price target of $200, which implies upside potential of 24.7% from current levels.

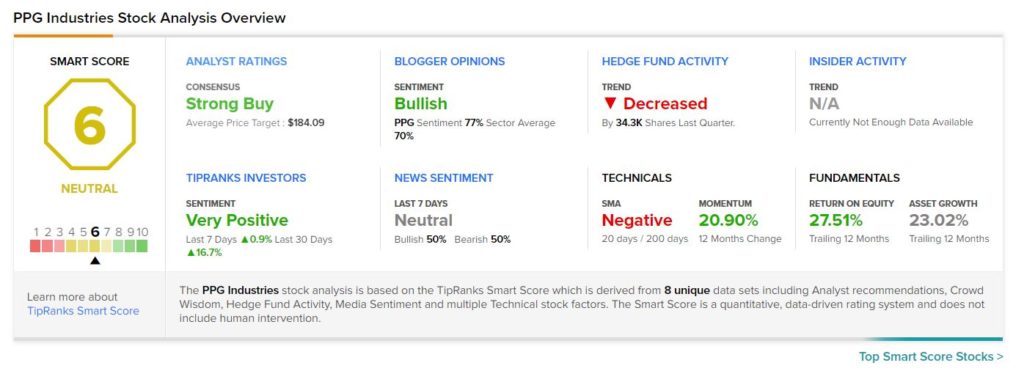

Consensus among analysts is a Strong Buy based on 9 Buys and 2 Holds. The average PPG price target of $184.09 implies upside potential of 14.8% from current levels.

PPG scores an 6 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock is likely to perform in line with market expectations. Shares have gained about 19.7% over the past year.

Related News:

Winnebago Industries Posts Q4 Beat; Shares Pop 2.4% in Pre-Market

Nasdaq Q3 Results Surpass Street’s Expectations

Omnicom Delivers Mixed Q3 Results; Shares Slip After-Hours