The Q1 earnings results of Plug Power (PLUG) fell short of the consensus estimates and its stock fell almost 10% during extended trading on May 9, shortly after the results came out. The stock had dropped more than 14% in the regular trading session.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Headquartered in New York, Plug Power develops hydrogen fuel cell systems that power a variety of machines, including forklifts. Its customers include major retailers such as Amazon (AMZN), Walmart (WMT), and Carrefour.

Q1 Earnings Numbers

Revenue of $140.8 million nearly doubled from $71.96 million in the same quarter the previous year, but fell short of the consensus estimate of $144.49 million. Similarly, the loss per share of $0.27 more than doubled from $0.12 loss per share a year ago and missed the consensus estimate of $0.16 profit per share.

Outlook

While it generated revenue of $502 million in 2021, Plug Power anticipates its revenue to rise to as much as $925 million in 2022 and hit $3 billion in 2025. It also expects significant margin expansion by then. The company counts on its green hydrogen production network to contribute to its growth and margin improvements.

Wall Street’s Take

The rest of the Street is cautiously optimistic about PLUG stock with a Moderate Buy consensus rating. That’s based on eight Buys versus three Holds. The average Plug Power price target of $39.73 implies 138.9% upside potential to current levels. Shares have declined more than 42% year-to-date.

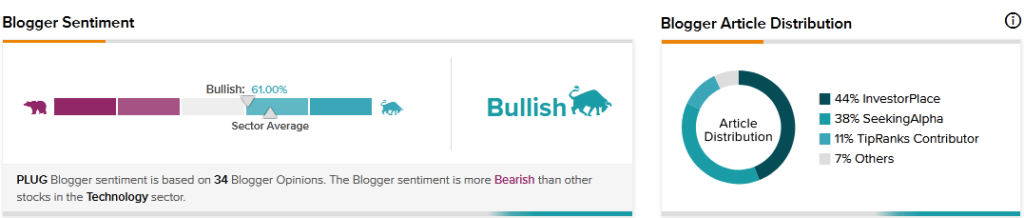

Blogger Opinions

TipRanks data shows that financial blogger opinions are 61% Bullish on PLUG, compared to a sector average of 68%.

Key Takeaway for Investors

Although Plug Power’s Q1 earnings fell short of expectations, the company’s prospects look bright. Its solutions support the shift to clean energy, which the world needs amid the efforts to combat climate change. Furthermore, once Plug Power completes its green hydrogen production plants, it expects to see margin improvements.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Ross Gerber Trolled for his Tweet on Tesla’s Succession Planning

Beazley Reports Strong Q1 Results, Shares Up 5.58%

Omar Navarro’s Tweet Lauds Musk as Apple/Android Competitor