In this piece, I evaluated two software stocks, Palantir Technologies (NYSE:PLTR) and ServiceNow (NYSE:NOW), using TipRanks’ Comparison Tool to see which is better. A closer look suggests neutral views of both, although a clear winner emerges.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

While both are software companies, Palantir Technologies specializes in big-data analytics, serving institutions, private enterprises and non-profit organizations. ServiceNow provides cloud-computing solutions to enterprises to help them manage their digital workflows.

Palantir stock has soared 57% year-to-date, pulling its 12-month return into the green at 36%. Meanwhile, ServiceNow stock is up 14% year-to-date and 39% over the last year.

With such a dramatic difference in the companies’ share-price returns year-to-date, the sizable gap between their valuations is no surprise. We’ll compare their price-to-earnings (P/E) ratios to gauge their valuations against each other and that of their industry.

For comparison, the application software industry is trading at a P/E of 101x versus its three-year average of 151x.

Palantir Technologies (NYSE:PLTR)

At a P/E of 211.8x, Palantir has charged far ahead of ServiceNow in terms of its valuation, although its forward multiple of 80x makes it look far more attractive. However, the stock is trading at the high end of its typical valuation range of 185x to 256x since becoming profitable, so a neutral view seems appropriate.

While Palantir is putting up robust growth, it doesn’t quite have the same enormous growth rates as some long-running growth stocks. In the latest quarter, the company’s revenue rose 21% year-over-year.

The problem with forward multiples is that there is no guarantee of future results. So, for a company like Palantir, which is not even notching $1 billion in quarterly revenue yet, this high current valuation bears monitoring because it doesn’t leave any room for error. Thus, upcoming earnings releases could bring bouts of volatility.

Palantir is scheduled to release its next earnings report on August 5, and analysts are looking for adjusted earnings of eight cents per share on $652.46 million in revenue. In the year-ago quarter, Palantir posted adjusted earnings of five cents per share on $533.3 million in revenue.

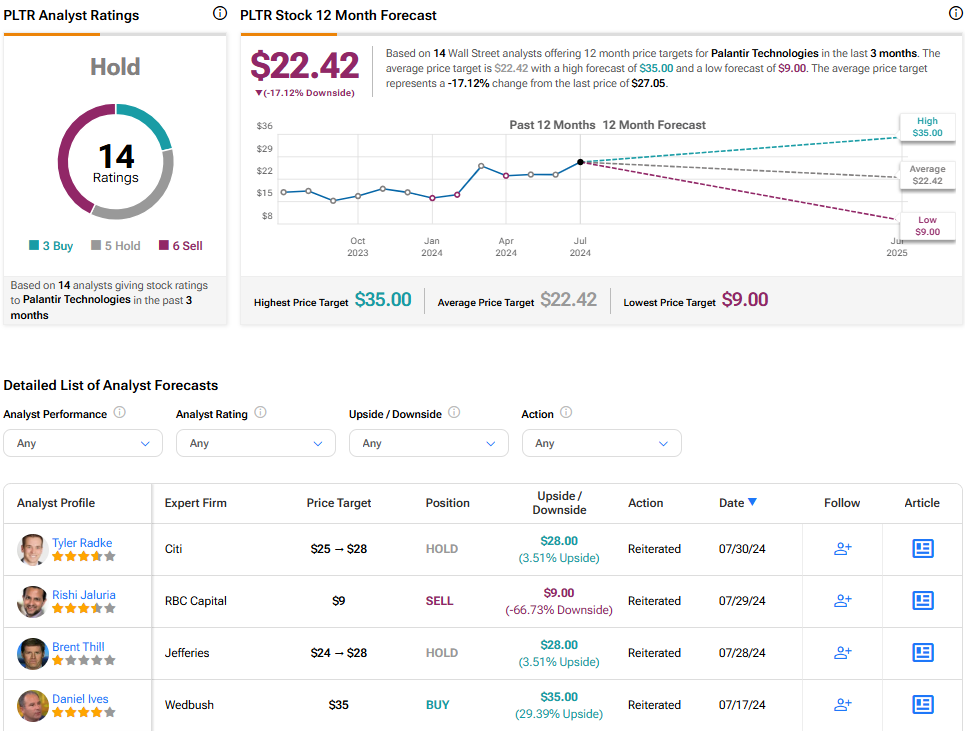

What Is the Price Target for PLTR Stock?

Palantir Technologies has a Hold consensus rating based on three Buys, five Holds, and six Sell ratings assigned over the last three months. At $22.42, the average Palantir Technologies stock price target implies downside potential of 17.1%.

ServiceNow (NYSE:NOW)

At a P/E of 144.4x, ServiceNow looks far more reasonably valued, albeit higher than the industry’s current valuation. The forward P/E of 55.5x makes the stock look even more attractive, but a neutral view seems appropriate because the stock is trading at the top of its valuation range of 77x to 145.5x over the past year.

In the second quarter, ServiceNow posted adjusted earnings of $3.13 per share on $2.63 billion in revenue versus expectations of $2.83 per share on $2.61 billion in revenue. Revenue rose 22% year-over-year, which is very solid growth on top of a large, multi-billion-dollar base.

CEO Bill McDermott’s statement about ServiceNow’s relevance in generative AI being “stronger than ever” is certainly good news. However, I’d like to see the company’s valuation decline a bit before becoming more constructive on the stock.

Additionally, as an AI stock, ServiceNow shares are subject to extreme excitement or perhaps a touch of irrational exuberance that could slow down at some point, creating a nice buy-the-dip opportunity.

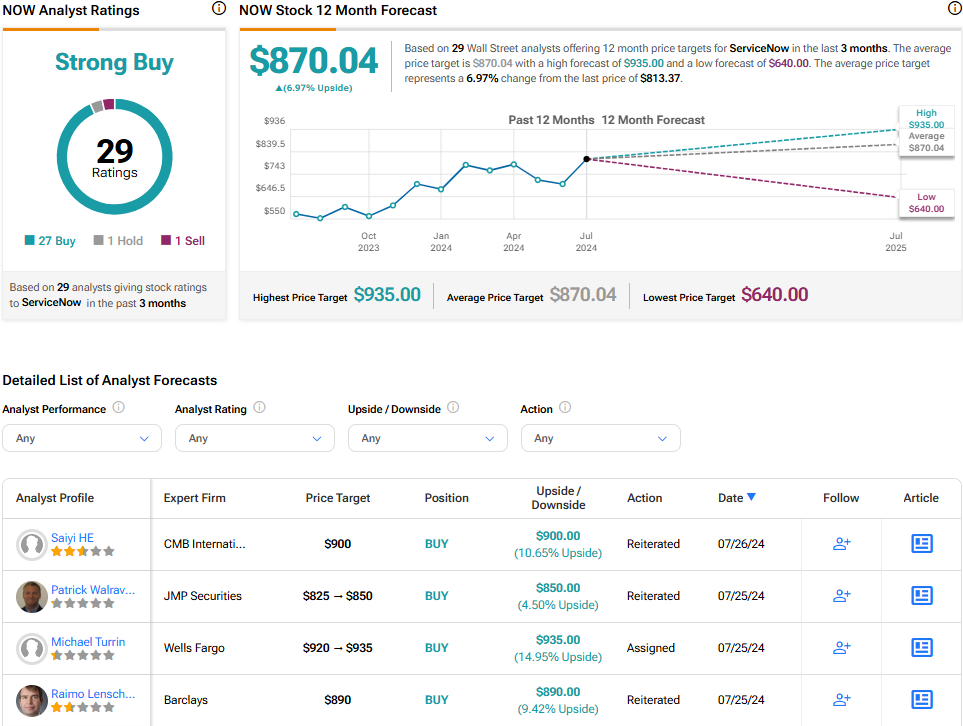

What Is the Price Target for NOW Stock?

ServiceNow has a Strong Buy consensus rating based on 27 Buys, one Hold, and one Sell rating assigned over the last three months. At $870.04, the average ServiceNow stock price target implies upside potential of 7%.

Conclusion: Neutral on PLTR and NOW

Although both companies receive neutral ratings, ServiceNow looks much closer to a bullish rating. The company’s growth rate is quite solid on such a large revenue base, and while its stock has been benefiting from the AI hype, it doesn’t look quite as overvalued as many other AI names. Thus, I’d probably monitor this stock for a buy-the-dip opportunity.

On the other hand, Palantir Technologies just looks overvalued, especially given that its quarterly revenue hasn’t surpassed $1 billion yet. I’d have to see this stock price come down significantly before seriously considering it as a potential portfolio addition.