Shares of Pinduoduo closed 12.7% higher on Friday after JPMorgan upgraded the stock to Buy from Hold and doubled the price target to $160 (5.8% upside potential).

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

JPMorgan analyst Alex Yao raised Pinduoduo (PDD) following the e-commerce platform provider’s stronger-than-expected 3Q results released on November 12.

Pinduoduo’s 3Q revenues of $2.09 billion topped Street estimates of $1.86 billion. Meanwhile, its adjusted earnings per American Depository Share (ADS) of $0.05 also compared to analysts’ expectations of $0.17 loss per ADS. The company’s average monthly active users, a key financial metric, jumped 50% to 643.4 million year-over-year. (See PDD stock analysis on TipRanks)

In a note to investors, Yao commented that Pinduoduo’s continued strong gross merchandise value (GMV) and user growth with lower spending supports the viability of the company’s business model over the long run. The analyst projects that its revenue would grow year-on-year by 60% in 2021 and by 40% in 2022, thereby supporting the stock’s premium valuation.

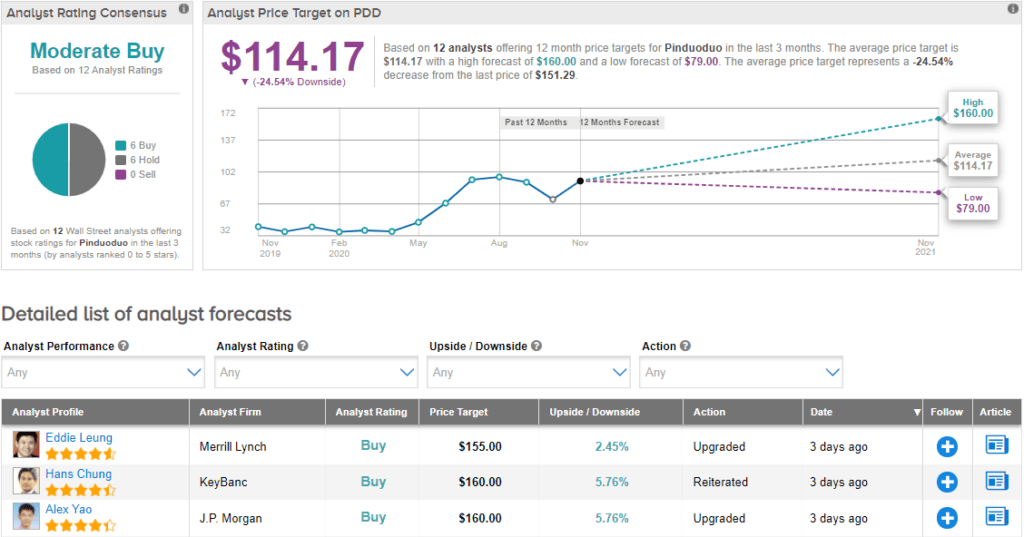

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 6 Buys and 6 Holds. The average price target stands at $114.17 implying downside potential of about 24.5% to current levels. Shares up over 300% year-to-date.

Related News:

McDonald’s Enacts New Safety Measures as COVID Cases Climb

Qualcomm To Sell 4G Chips To Huawei – Report

Reynolds Consumer Up 5% On Upgraded Earnings Outlook