Philip Morris International, Inc. (NYSE: PM) has announced that it plans to suspend investments and wind down production in Russia. This follows the company’s announcement on March 9 to scale down its manufacturing operations in the country.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Philip Morris has already stopped selling its numerous cigarette products in Russia and plans to cut local production of these products accordingly. It has also suspended its marketing activities in the transcontinental nation.

Further, the tobacco company has canceled the launches of all its products planned for this year, including IQOS ILUMA, its flagship heated tobacco product, which was scheduled to be launched this month.

Additionally, Philip Morris has terminated its plan to invest $150 million in Russia to produce over 20 billion TEREA sticks for IQOS ILUMA.

Finally, the New York-based company’s senior executives and board are considering exiting the country due to the continuously changing operating and regulatory environment.

The CEO of Philip Morris, Jacek Olczak, said, “We employ more than 3,200 people in Russia. We continue to support them, including paying their salaries, and we will continue to fulfill our legal obligations.”

Last year, Russia accounted for around 6% of the company’s net revenues and nearly 10% of its shipment volumes.

Philip Morris manufactures and sells cigarettes, tobacco, nicotine-containing products, smoke-free products and related electronic devices and accessories in over 180 countries. The company’s most popular and bestselling brand is Marlboro.

PM stock jumped 1.5% on Thursday to close at $92.58.

Stock Rating

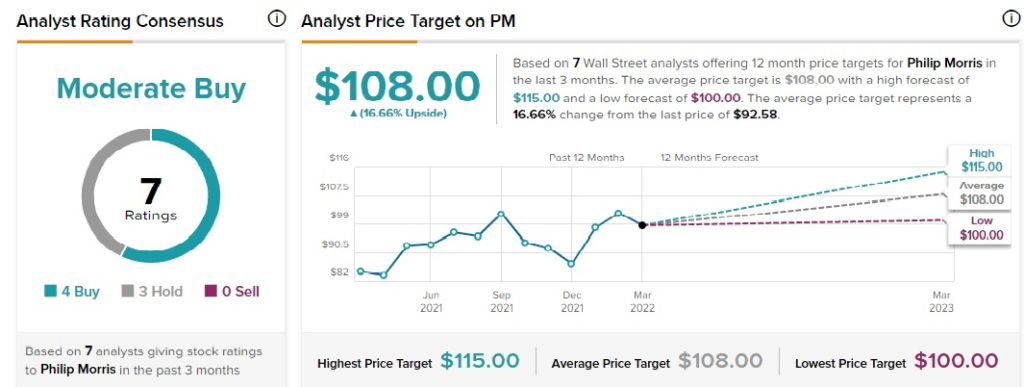

Recently, Goldman Sachs (NYSE: GS) analyst Bonnie Herzog downgraded the rating on the stock to Hold from Buy and lowered the price target to $100 from $116 (8% upside potential).

The analyst believes the Russia-Ukraine crisis is a matter of concern for Philip Morris, as these two nations contribute nearly 8% to the company’s revenues. The disruption and the unfavorable exchange rate movements that the conflict has caused could require the company to lower its full-year 2022 guidance.

Additionally, Herzog expects the crisis and semiconductor shortages to impact the long-term plans of IQOS ILUMA.

The analyst expects the company to grow in the long term. “Philip Morris is in the middle of an impressive transformation of its business (and industry) to deliver a smoke-free future which we believe will ultimately create long-term shareholder value,” said Herzog.

Overall, the stock has a Moderate Buy consensus rating based on four Buys and three Holds. Philip Morris’ average price target of $108 implies 16.6% upside potential. Shares have gained almost 10% over the past year.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Moody’s to Stop Rating Russian Companies

Moderna Ups 2022 COVID-19 Vaccine Sales Guidance — Report

ABB to Launch Share Buyback Program of up to $3B