Philip Morris International Inc. (PM) inked a deal to acquire Fertin Pharma for $820 million (or DKK 5.1 billion). The acquisition will accelerate the company’s ambition to become a majorly smoke-free business by 2025 and build a robust beyond-nicotine product portfolio.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Shares of the leading multinational cigarette and tobacco company, which also manufactures smoke-free products, have jumped 42% over the past year. (See PM stock chart on TipRanks)

The offer price implies a valuation multiple on 15x Fertin Pharma’s EBITDA reported in 2020. Fertin Pharma develops innovative pharmaceutical products based on oral and intra-oral delivery systems. Fertin Pharma recorded net revenues of $160 million (or DKK 1.1 billion) in 2020.

Through the acquisition, PMI will gain access to valuable know-how for the development of existing and new smoke-free platforms. Furthermore, the addition of Fertin Pharma will enhance PMI’s R&D and manufacturing capabilities in nicotine and beyond nicotine products.

Philip Morris CEO Jacek Olczak commented, “Fertin’s diverse portfolio of technologies, evolving business mix, and world-class expertise will enrich our innovation pipeline and capabilities, providing speed and scale in oral delivery to support our 2025 goals of generating more than 50% of our net revenues from smoke-free products and at least USD 1 billion from products beyond nicotine.”

At the beginning of the year, PMI said that it intended to enhance its capabilities in life sciences, product innovation, and clinical expertise to extend its portfolio beyond tobacco and nicotine. This deal, which it will finance with available cash, aligns with PMI’s stated goal.

The acquisition is expected to close in the fourth quarter of 2021, subject to certain mandatory approvals. Upon completion, Fertin Pharma will operate as a wholly-owned subsidiary of PMI.

Piper Sandler analyst Michael Lavery recently increased the price target on the stock from $111 to $114 (15% potential upside) and reiterated a Buy rating.

Lavery remains immensely impressed by the company’s “heat-not-burn product” iQOS which now boasts 19 million users. Notably, it has added one million users every quarter since the first quarter of 2019.

Further, he is optimistic that the number of users will increase in the second of the current year given the launch of its easy-to-use, next-generation iQOS Iluma device.

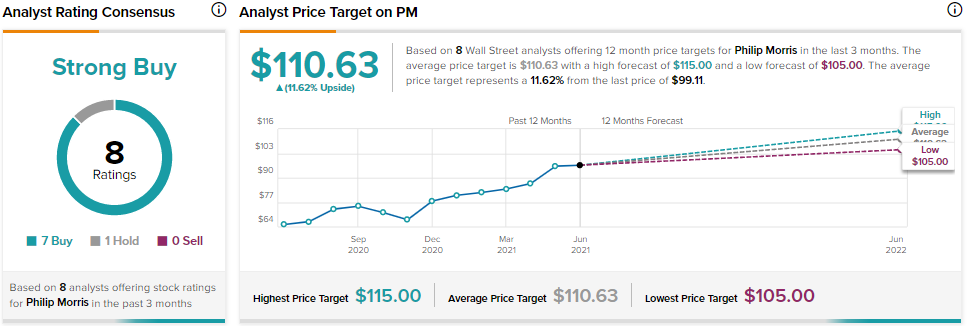

Overall, the stock has a Strong Buy consensus rating based on 7 Buys and 1 Hold. The average Philip Morris price target of $110.63 implies 11.6% upside potential from current levels.

Related News:

Hewlett Packard Enterprise Boosts 5G Portfolio with Automated Solutions

Guidewire’s InsuranceSuite Selected by Mountain West Farm Bureau Mutual Insurance

XPO Logistics Prices Common Stock Offering of 5 Million Shares; Shares Drop