Shares in PG&E Corp. (PCG) sank as much as 13% in pre-market trading after the debt-strapped U.S. utility announced that a group of investors agreed to commit to a $3.25 billion equity investment at a discounted share price.

The U.S. utility disclosed that a number of investors, including Appaloosa, Third Point LLC, Fidelity Management & Research Co. LLC and Zimmer Partners, have committed to buy shares at a price of up to $10.50 in an offering to generate $3.25 billion. The stock plunged as much as 13% in pre-market trading to $10.95 after closing at $12.52 on Friday.

The equity investment agreement is part of the power provider’s plan to raise a total of $5.75 billion from public offerings as it embarks on a plan to exit from its bankruptcy, it said in a SEC filing.

Over the weekend, Reuters reported that PG&E is working on a $11 billion debt-financing package as it seeks to come out of Chapter 11 proceedings by June 30 to tap a state-backed fund that would help utilities cope with the financial fallout suffered from wildfires.

In January last year, the utility filed for bankruptcy, citing potential liabilities exceeding $30 billion from major wildfires sparked by its equipment in 2017 and 2018.

It looks like some investors are welcoming PG&E’s plan to emerge out of bankruptcy. Since hitting this year’s low in March, shares have surged more than 70%.

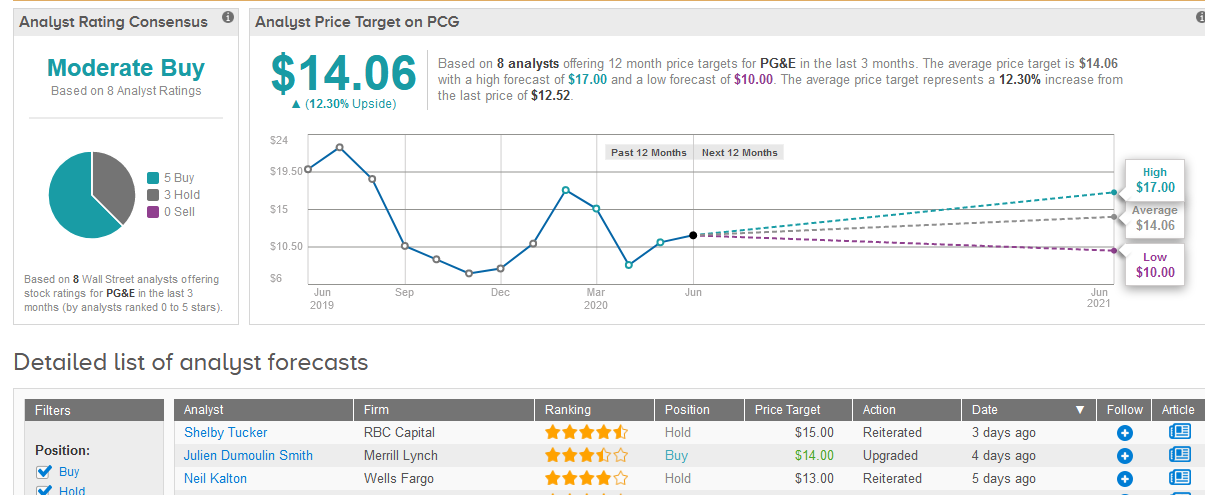

Merrill Lynch analyst Julien Dumoulin Smith on Friday reiterated a Buy rating on the company with a $14 price target, saying that with approvals and a reorganization plan in place, the stock offers a “much cleaner story”.

“Under conservative assumptions we calculate shares as offering compelling total return prospects with additional catalyst potential if the backstop agreement were amended to provide better terms,” Dumoulin Smith wrote in a note to investors.

Overall, the Wall Street analyst community is cautiously optimistic on the stock. The Moderate Buy consensus consists of 5 Buy versus 3 Hold ratings. The $14.06 average price target implies shares may gain another 12% in the coming 12 months. (See PG&E stock analysis on TipRanks).

Related News:

PG&E Is Said To Ready $11 Billion Debt Financing Plan

Colombian Carrier Avianca Files for Bankruptcy Protection Due to Coronavirus Woes

S&P Cuts American Airlines’ Credit Rating To ‘B-‘ from ‘B’ On Cash Flow Deficit Concern