Procter & Gamble (P&G) reported FY 2Q21 adjusted earnings of $1.64 per share that came in ahead of analysts’ estimates of $1.51 per share as consumers piled up on cleaning and cosmetics products during the coronavirus pandemic.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The consumer goods giant generated second-quarter revenue of $19.7 billion, reflecting growth of 8% year-on-year. Analysts had been looking for $19.3 billion.

Shares closed at $131.93 on Jan. 20. The company earned $1.47 per share on a diluted basis, up by 4% year-on-year. For FY21, P&G (PG) expects diluted earning per share (EPS) to grow in the range of 8% to 10% from FY20 EPS of $4.96.

“We delivered another strong quarter of results across all key measures – top line, bottom line and cash. We remain focused on executing our strategies of superiority, productivity, constructive disruption and improving P&G’s organization and culture,” commented P&G CEO David Taylor. “These strategies enabled us to build strong business momentum before the COVID crisis, accelerated our progress in calendar year 2020 and remain the right strategies to deliver balanced growth and value creation over the long term.”

Additionally, P&G raised its FY21 sales outlook. The company now projects revenue to grow in the range of 5% to 6%, up from an earlier range of between 3% to 4%. The lifted FY21 outlook includes headwinds from currency fluctuations, higher freight costs, and higher interest expense.

Furthermore, P&G intends to pay around $8 billion in dividends in FY21 and expects to buy back shares of up to $10 billion during the same period. (See PG stock analysis on TipRanks)

Ahead of the earnings results, Jefferies analyst Kevin Grundy on Jan. 19 reiterated a Buy rating on the stock but reduced the price target from $169 to $168.

“We expect PG to lift its FY21 guide w/strong demand, USD weakness, and productivity, partially offset by commodities. PG (and staples) continue to lag S&P 500 leaving shares at ~22.5x NTM P/E, which is relative low vs. mkt since ’08-09 downturn,” Grundy wrote in a note to investors.

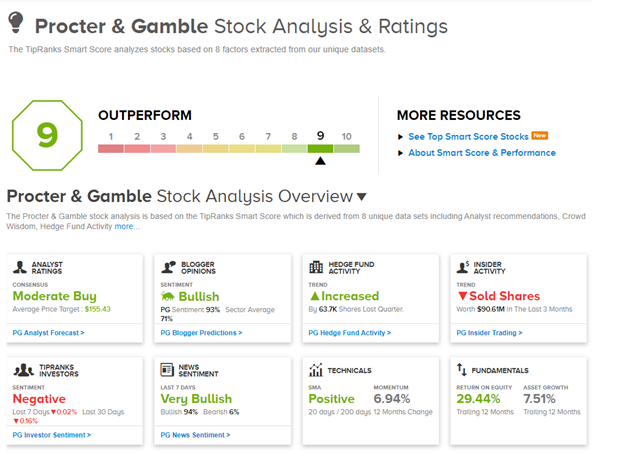

Overall, analysts remain cautiously optimistic about the stock and the consensus is a Moderate Buy with 4 analysts suggesting a Buy and 3 analysts recommending a Hold. The average price target of $155.43 implies 19% upside potential to current levels.

As per the TipRanks Smart Score system, Procter & Gamble scores a 9 out of 10, which indicates a high likelihood of outperformance.

Related News:

Netflix’s Subscriber Growth Fuel 4Q Sales Boom; Shares Pop 12%

JPMorgan’s 4Q Profit Beats Analysts’ Estimates

Logitech Lifts FY21 Outlook After 3Q Beat; Street Is Bullish