Pfizer Inc. (PFE) has sold its stake worth $3.26 billion in UK-based consumer healthcare company Haleon PLC (GB:HLN). With this transaction, Pfizer’s ownership in Haleon has been reduced to 15% from 22.6%. Following the announcement, Haleon shares fell by 0.43% as of writing.

Haleon was formed in July 2019 through the merger of GlaxoSmithKline’s (GB:GSK) and Pfizer’s consumer healthcare businesses. Subsequently, in July 2022, GSK spun off Haleon as an independent publicly traded company. Haleon owns popular brands such as Sensodyne, Centrum, Otrivin, and Eno.

Pfizer Continues to Trim Haleon Stake

The recent sale is part of Pfizer’s ongoing strategy of gradually reducing its stake in Haleon. Previously, Pfizer had announced its intention to completely divest its holdings in Haleon over time. As a result, Pfizer has steadily decreased its stake in Haleon from 32% at the time of its IPO. Similarly, GSK confirmed its fourth divestment in May 2024, marking its exit from Haleon. Even after this sale, Pfizer remains the largest shareholder in Haleon.

Additionally, Haleon confirmed that it will purchase approximately 60.5 million of its shares from Pfizer for £3.80 per share for £230 million. With this purchase, Haleon will fulfil its commitment to return £500 million to shareholders through share buybacks this year.

Haleon Expects Profit Growth in 2024

In August, Haleon reported an 11% year-over-year jump in its adjusted operating profit in the first half of 2024. This growth was mainly driven by strong demand for the company’s oral care products and vitamins.

Moving forward, the company expects high single-digit growth in organic operating profit for 2024.

What Is the Price Prediction for Haleon Stock?

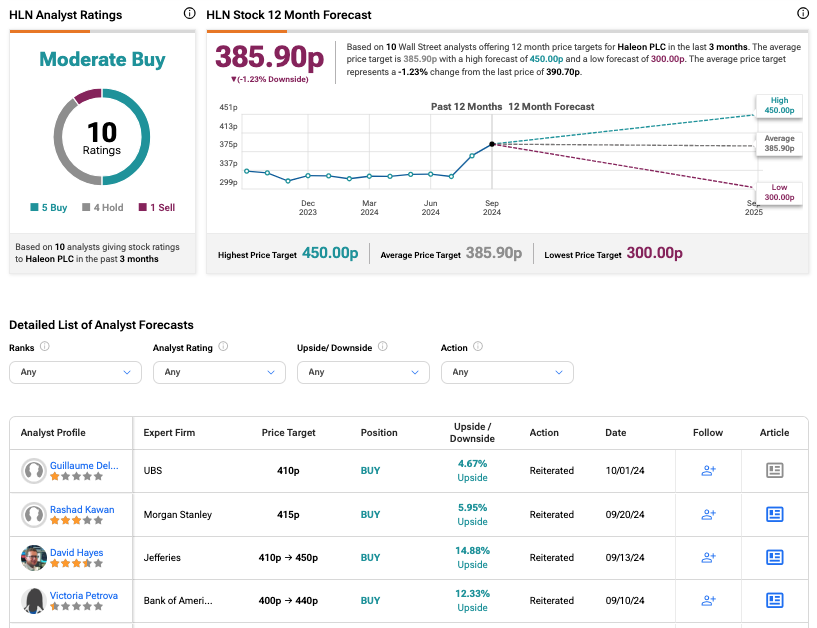

Today, UBS analyst Guillaume Delmas reiterated a Buy rating on HLN stock, predicting an upside of 4.7%.

According to the consensus on TipRanks, HLN stock has received a Moderate Buy rating. This rating is backed by five Buys, four Holds, and one Sell recommendation. The Haleon share price forecast is set at 385.90p, indicating a decline of 1.23% from the current level.

Questions or Comments about the article? Write to editor@tipranks.com