Pfizer ramped up its 2021 full-year guidance as the US drug maker expects to generate $15 billion from the sale of its COVID-19 vaccine. However, shares fell 2.4% in US morning trading as the company’s fourth-quarter earnings lagged analysts’ estimates.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Meanwhile, Pfizer (PFE) increased its full-year earnings per share guidance for this year due to “additional refinements of its COVID-19 vaccine revenue forecast” to a range of $3.10 to $3.20, up from $3 to $ 3.10. Analysts had been looking for EPS of $3.19. Throughout the course of this year, the vaccine maker expects to generate $59.4 billion-$61.4 billion from sales.

In the fourth quarter, Pfizer earned an adjusted 42 cents per share, missing analysts’ expectations of 48 cents per share mainly due to higher expenses. Revenue during the reported quarter increased 12% to a total $11.7 billion year-on-year, beating the Street consensus of $11.43 billion.

Pfizer’s BNT162b2 COVID-19 vaccine, which was granted emergency use authorization (EUA) in the US in December, contributed $154 million in sales in the fourth quarter. The vaccine has now been granted temporary authorization in more than 50 countries worldwide.

“2020 has been a transformational year. We saw the culmination of Pfizer’s decade-long conversion into a pure-play, science and innovation-focused company,” Pfizer CEO Albert Bourla said. “Our record-breaking success at developing a vaccine against COVID-19, along with our partner BioNTech, is just one example of what we believe this new Pfizer is capable of achieving.”

Shares of Pfizer have declined about 4% over the past five days and have gained almost 1% over the past year. (See Pfizer stock analysis on TipRanks)

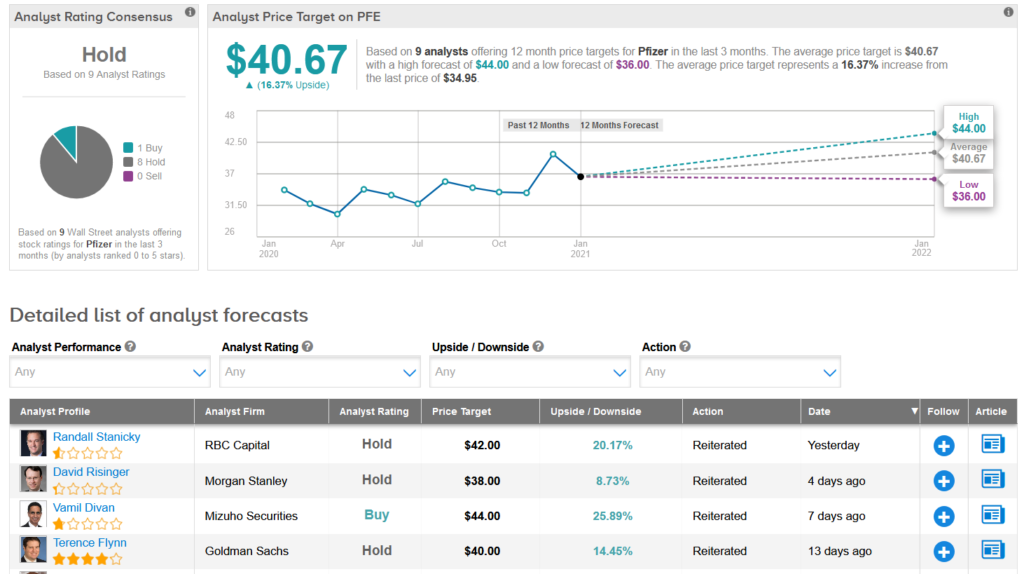

Following the earnings release, Mizuho Securities analyst Vamil Divan reiterated a Buy rating on the stock with a $44 price target (23% upside potential).

“Overall, there are multiple moving parts to the Pfizer story right now, but we believe their core assets are performing well, as we wait to see if pipeline success can get investors more comfortable with Pfizer’s 2026-2030 outlook,” Divan wrote in a note to investors.

Meanwhile, the Street’s consensus rating on the stock is a Hold. That’s based on 8 Holds vs. Divan’s Buy. Looking ahead, the average analyst price target stands at $40.67, putting the upside potential at about 16% over the next 12 months.

Related News:

AstraZeneca To Supply Another 9M COVID-19 Vaccine Doses After EU Nod

Microsoft’s Cloud Services Fuel 2Q Sales Beat; Shares Rise

Starbucks’ Profit Outlook Disappoints; Shares Fall