Shares of Pfizer (PFE) gained in pre-market trading on Tuesday after the company reported strong third-quarter results. The pharmaceutical and biotech company swung to a profit in the third quarter and reported adjusted earnings of $1.06 per share, above consensus estimates of $0.61 per share.

PFE’s Oncology Portfolio Drives Growth in Q3 Revenues

Furthermore, the company’s revenues increased by 31% year-over-year to $17.7 billion. This exceeded analysts’ expectations of $14.9 billion. Pfizer’s growth in revenues in the third quarter was driven by its treatment for COVID-19, Paxlovid, and the strong performance of its Oncology drugs portfolio.

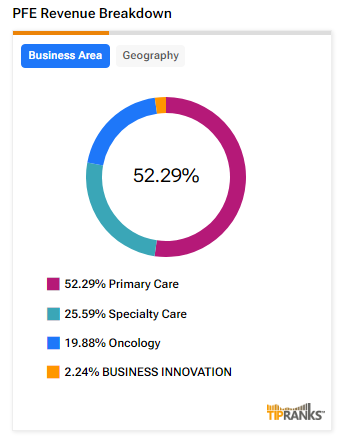

In fact, this business segment posted revenues of $4.04 billion in the third quarter, up by 29.8% year-over-year, and comprised more than 19% of PFE’s total revenues.

PFE Raises FY24 Outlook

Looking ahead, management now expects FY24 revenues in the range of $61 billion to $64 billion, compared to its prior forecast between $59.5 billion and $62.5 billion. In addition, adjusted earnings are estimated to be in the range of $2.75 to $2.95 per share, compared to the previous outlook between $2.45 and $2.65 per share. For reference, analysts estimate earnings of $2.66 per share on revenues of $61.1 billion.

The company’s raised outlook now includes around $10.5 billion in anticipated revenues generated from its COVID-19 drugs, Comirnaty and Paxlovid. Furthermore, Pfizer now expects that its cost-saving initiatives will result in delivering at least $4 billion in savings by the end of this year. Moreover, the first phase of the cost-saving initiative is likely to deliver $1.5 billion in savings by 2027.

Is PFE a Good Stock to Buy?

Analysts remain cautiously optimistic about PFE stock, with a Moderate Buy consensus rating based on seven Buys and 14 Holds. Year-to-date, PFE has increased by more than 4%, and the average PFE price target of $32.47 implies an upside potential of 12.5% from current levels. These analyst ratings are likely to change following PFE’s results today.