You might have heard of qualified dividends, and wondered whether the dividends you receive have qualified. Essentially, qualified dividends are the same as ordinary dividends, with one crucial difference: the Internal Revenue Service (IRS) taxes qualified dividends at the capital gains taxation rate instead of as ordinary income.

Many publicly-traded stocks can be considered qualified dividends, assuming they meet a number of conditions that are mostly related to the amount of time they are held by investors.

Having your dividends taxed at the capital gains rate can represent a significant savings in your tax obligations, so it is important to understand if your dividends are indeed qualified.

What are Dividends?

Dividends are payments that companies make to shareholders, usually on a quarterly basis. These regular payments are a means for these firms to share their profits with their owners, and provide an additional incentive for investors to purchase these stocks.

Not every publicly-traded company makes dividend payments. Those that do so are generally larger, more well-established firms who seek to offer additional incentives to investors, in lieu of the more significant potential for gains that are an inherent selling point of growth stocks (See Dividend vs. Growth Stocks: What’s the Difference? for an in-depth explanation and comparison between these two types of stocks).

Dividend-paying stocks can be an important part of your investment strategy, bringing value to your overall portfolio while earning you money throughout the year. In fact, dividends can be considered a form of passive income, as they allow you to enjoy a constant stream of earnings without actively working for it.

What Qualifies as a Qualified Dividend?

Qualified dividends are paid via the same mechanism as ordinary dividends, but certain conditions have to be met for them to be categorized as qualified.

The first and most basic qualification is that the owner has held the dividend-paying stock over a certain period of time. This comprises two stipulations:

- Holding Period: The investor has held the stock for at least 61 out of the 120 days prior to the ex-dividend date. (For preferred stock, this changes slightly to 91 out of 180 days.); and

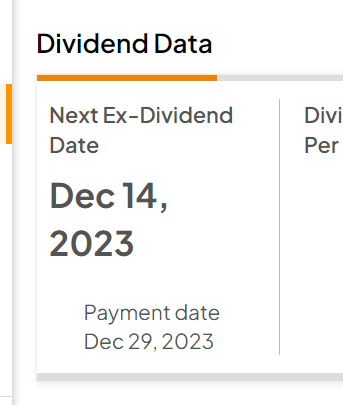

- Ex-Dividend Date: The investor has been holding the stock on the Ex-Dividend Date. The Ex-Dividend Date is one day prior to the Record Date, when companies review their list of shareholders to determine who is eligible to receive a dividend payment.

The second qualification is that there were no hedges on the shares during the 61 (or 91) day holding period. In other words, these shares were being held as investments, instead of being used for speculative trading processes such as calls, puts, or short-selling. Day traders who happened to hold the stock on the ex-dividend date would not qualify, unless they elected to hold onto the shares for a longer period of time.

Another important condition is that these dividends are being paid either by an American company or by one with strong foundations in the United States. Foreign companies can qualify if they satisfy at least one of the following three criteria:

- (1) The company is incorporated in one of the 50 U.S. states or in a U.S. possession;

- (2) The company is located in a nation that has a Comprehensive Tax Treaty in force with the U.S.;

- (3) The company is traded on a U.S. stock exchange.

Lastly, there are certain types of investments whose dividends do not qualify by definition. These include Real Estate Investment Trusts (REITs) and employee stock options.

How to Ensure Your Dividends are Qualified

If you own dividend-paying stocks that fit the above qualifications, it is important to make sure that your dividends are classified as qualified.

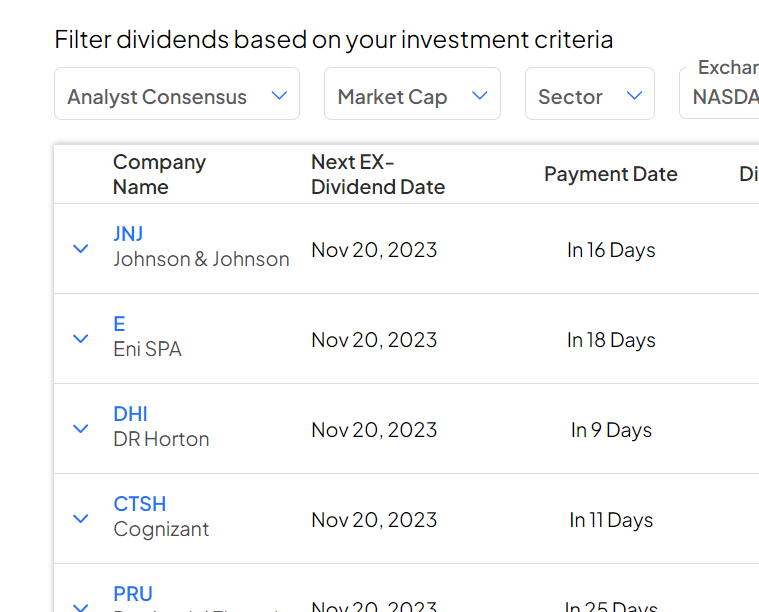

First, understand when the next Ex-Dividend Date is. You can use the TipRanks’ Dividend Calendar to find out the Ex-Dividend Dates for publicly traded stocks:

If the ex-dividend date is over 61 days away, make sure that you buy and hold onto this equity throughout this time period in order to make sure that your payments considered as qualified dividends.

The TipRanks’ Dividend Calendar allows you to easily see upcoming Ex-Dividend Dates for various stocks, allowing you to include this criteria in your investment decision-making.

What Are the Advantages of Qualified Dividends?

The benefits of qualified dividends are felt when tax season rolls around, as income made from these investments is taxed at a lower rate. The specific taxation rate on a number of personal circumstances, such as your filing status and overall levels of income.

Capital gains is considered income that is made via the profits that are realized through the increase in the value of an asset. This is generally lower than what you pay on income from your job, which is taxed via your marginal rate of taxation.

The capital gains taxation rate ranges from 0-20%. In contrast, the marginal taxation rate is between 10-37% of your earnings, so there is a meaningful difference to your bottom line that can be gained by making sure that your dividends are qualified.

What Makes a Dividend Ordinary?

Ordinary dividends are simply those that do not qualify as qualified dividends. This does not mean that they do not bring value, however.

Dividends can be a central part of your investment strategy, by providing a means to increase the value of your portfolio through the appreciate of assets while also earning regular payments. This is as true for ordinary dividends as it is for qualified ones.

By and large, income that you earn is taxable. Ordinary dividends are taxed at a higher rate than qualified dividends. Therefore, if you are invested in a company that qualifies, it makes good financial sense to ensure that you are holding onto your shares for a sufficient period of time in order to qualify for this reduced rate of taxation.

Conclusion: Growing Your Portfolio With Qualified Dividends

The benefits of dividends are multiple, and can help you realize your financial goals. To maximize your wealth (and limit your tax burden), if presented with the option, make sure that your dividends qualify as qualified.

Learn money management, and use data-driven stock insights with TipRanks.