PepsiCo, Inc. is expected to post a larger-than-forecast profit for the full year as the coronavirus pandemic fuels demand for its snacks and its global beverage business returned to growth.

PepsiCo (PEP) forecasts full-year core earnings of $5.50 per share, which is above the Street consensus of $5.36 per share. The upbeat guidance comes as the beverage giant reported that it earned $1.66 per share on an adjusted basis in the third quarter ended Sept. 5, exceeding analysts’ expectations of $1.49 per share.

Total sales increased 5.3% to $18.09 billion in the third quarter, beating analysts’ expectations of $17.23 billion. Net profit attributable to the company jumped 9.1% to $2.29 billion, or $1.65 per share.

In North America, sales of PepsiCo’s snack foods unit Frito-Lay and its Quaker foods continued to deliver robust growth as at-home consumption trends have remained strong even as some economies reopened some of their activities, the company said. The company’s snack foods include Tostitos, Cheetos and Doritos.

“Our North America businesses performed well in the quarter and we expect our snacks and foods businesses to remain resilient while our beverages business should sustain its momentum for the balance of this year,” said PepsiCo CEO Ramon Laguarta. “On the outlook for our international businesses, we expect our snacks business to remain resilient while the recovery for our beverage business may take more time due to ongoing and reinstated pandemic related restrictions and closures as it relates to certain channels.”

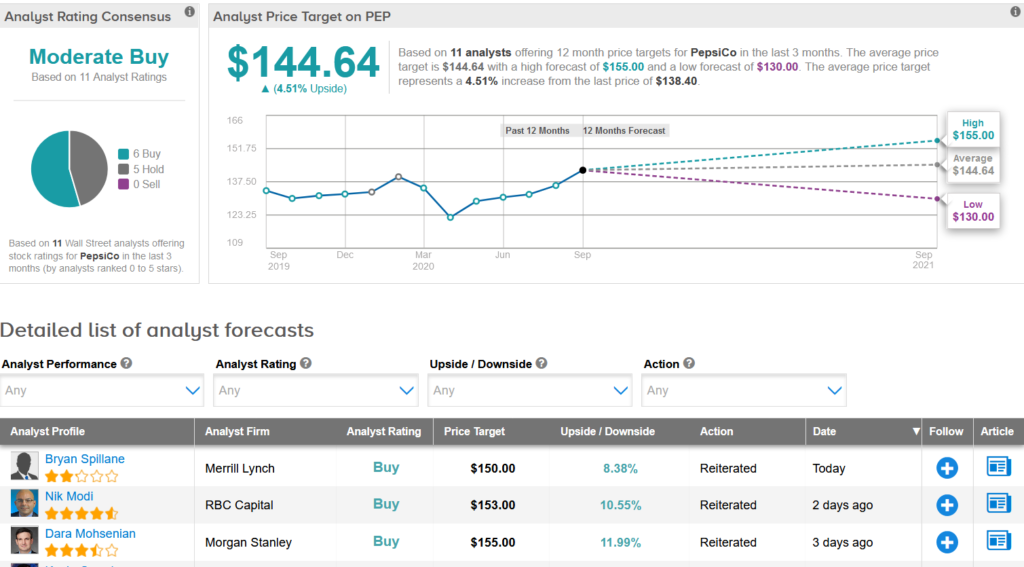

Commenting on the results, Merrill Lynch analyst Bryan Spillane said that although overall sales were strong and indicate confidence into 4Q and FY21, the beverage business in developing and emerging markets could remain volatile.

Spillane maintained a Buy rating on the stock with a $150 price target (8% upside potential), “based on 26.1x our FY21 EPS estimate, which is a premium to non-alcoholic beverage peers (25.0x) and is justified based on our view that PEP is well positioned to face a slow growing economy”. (See PepsiCo stock analysis on TipRanks).

“The company still plans on returning cash to shareholders via dividends and share buybacks even as COVID-19 remains a disruptive force on the business environment,” the analyst added.

Overall, the stock scores a cautiously optimistic Moderate Buy Street consensus. With shares up 2% year-to-date, the average analyst price target of $144.64 implies 4.5% upside potential over the coming year.

Related News:

STMicro Set To Top 2020 Revenue Guidance Driven By 3Q; Shares Surge 7%

Starbucks Hikes Dividend By 10%; Cowen Upgrades Stock To Buy

Nikola Pops 15% In Battle To Win Back Confidence