Global food and beverage giant PepsiCo, Inc. (PEP) reported better-than-expected fourth-quarter results with both earnings and revenue exceeding expectations.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

However, the company’s growth was hampered by the pandemic-driven increased transportation costs, higher input costs, mainly cooking oil and packaging material, as well as increased marketing and advertising expenses.

Despite the quarterly beat, shares fell 2.1% to close at $168.37 on February 10 after the company issued warnings going forward regarding inflationary pressures and gave a weak outlook for Fiscal 2022.

Better-Than-Expected Results

PepsiCo’s fourth-quarter adjusted earnings came in one cent better than analysts’ estimates at $1.53 per share. The number was higher than the prior-year adjusted earnings of $1.47 per share. The bottom line was impacted by inflationary headwinds as mentioned, and the company has already passed on some of the costs to customers, making the products pricier than before.

Similarly, PepsiCo’s quarterly net revenue climbed 12.4% year-over-year to $25.25 billion and meaningfully surpassed Street estimates of $24.24 billion.

Additionally, FY21 net revenue advanced 12.9% to $79.47 billion and adjusted earnings grew 13.4% annually to $6.26 per share.

Segmental Revenue

Looking at Q4 segmental organic revenue contribution, PepsiCo’s Frito-Lay North America segment grew 13%, Quaker Foods North America climbed 9%, and PepsiCo Beverages North America increased 13%. Meanwhile, Latin America’s net revenue rose 16%, Europe grew 8%, Africa, Middle East and South Asia grew 13% and Asia Pacific, Australia and New Zealand and China Region increased 18%.

Juice Transaction

The company completed the divestiture of Tropicana, Naked, and other select juice brands to PAI Partners for approximately $3.5 billion in cash in Q1FY22. FY21 revenue from these activities was approximately $3 billion.

This was followed by a 39% non-controlling interest in a new joint venture for which PepsiCo will act as the sole distributor of the portfolio of brands. Additionally, the company will mark a one-time $3 billion pre-tax gain from the transaction in Q1FY22.

Official Comments

Commenting on the solid results, PepsiCo Chairman and CEO, Ramon Laguarta, said, “Moving forward, we remain committed to building advantaged capabilities that can help us win in the marketplace and become an even faster, even stronger, and even better organization. Importantly, this includes putting sustainability and human capital at the center of everything we do with the recent implementation of PepsiCo Positive (pep+), a fundamental end-to-end transformation of what we do and how we do it to create growth and shared value.”

Rewarding Shareholder

The company also increased its annual common stock dividend for the 50th consecutive year to $4.60 per share, reflecting a 7% year-over-year jump. The dividend is payable effective June 2022.

Moreover, the company also announced a new share buyback program for its common stock up to $10 billion through February 28, 2026.

Weak FY22 Guidance

Based on the current growth momentum, PepsiCo guided for fiscal 2022 organic revenue growth of 6%. Further, FY22 adjusted earnings are projected at $6.67 per share, 6 cents lower than the consensus estimate of $6.73 per share.

Additionally, in FY22, the company expects to reward shareholders with $6.2 billion in dividends and $1.5 billion in common stock buybacks.

Analysts’ Take

Responding to PepsiCo’s results, Guggenheim analyst Laurent Grandet lifted the price target on the stock to $188 (11.7% upside potential) from $186 while maintaining a Buy rating.

Grandet is encouraged by the company’s strong Q4 organic growth and mixed FY22 guidance. The analyst is also impressed with the new share buyback and dividend hike announced by the company. All in, Grandet is happy with the company’s performance under CEO Laguarta and remains optimistic about PepsiCo’s future growth potential.

Overall, the stock has a Moderate Buy consensus rating based on 5 Buys and 6 Holds. The average PepsiCo price target of $179.45 implies 6.6% upside potential to current levels. Shares have gained 22.5% over the past year.

Stock Investors

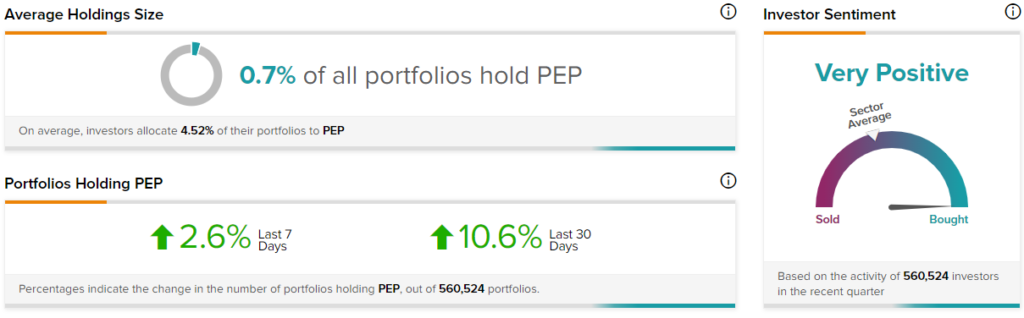

TipRanks’ Stock Investors tool shows that investor sentiment is currently Very Positive on PepsiCo, with 10.6% of portfolios tracked by TipRanks increasing their exposure to PEP stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Uber Soars on Stellar Q4 Results, Outpaces Expectations

XPeng Gains 9.6% on Inclusion in the Shenzhen-Hong Kong Stock Connect Program

Alibaba Surges after SoftBank Denies Stock Sale Speculation – Report