Food and beverage giant PepsiCo, Inc. (PEP) is scheduled to report its second-quarter earnings on July 13, before the market opens. Shares of the company have gained 4.2% over the past six months, closing at $148.91 on July 2.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

PepsiCo has consistently outperformed expectations over the past year however, the stock has gained little in comparison. It will be interesting to see if the second-quarter performance can bring the limelight back to the company and add some fizz to its shares. (See PepsiCo stock chart on TipRanks)

Earnings Preview

The Earnings Whisper numbers for Q2 EPS and revenue are expected to be $1.52 and $17.91 billion, respectively.

For the full year 2021, the company has guided for a high-single-digit increase in adjusted EPS and mid-single-digit growth in organic revenue (non-GAAP measure).

Prior Period Results

In the first quarter, adjusted earnings stood at $1.21 per share, up 13% year-over-year, and outpaced analyst estimates of $1.12 per share.

Net Revenue climbed 6.8% to $14.82 billion and surpassed the Streets’ estimates of $14.55 billion. Organic revenue grew 2.4% year-over-year.

In North America, the snacks business grew 3.7% year-over-year, while the beverages business increased 4.9%.

The combined snacks and beverages business across all the other regions increased 12% compared to the year-ago period. (See PepsiCo stock analysis on TipRanks)

Factors To Look For

Reaffirming the outlook for 2021, PepsiCo Chairman and CEO Ramon Laguarta said, “We remain fully committed to executing against our key set of priorities to become a Faster, Stronger, and Better organization and win in the marketplace. Following our first-quarter results, we have greater confidence in delivering on our financial guidance for the full year.”

The company is expected to report strong year-over-year results based on multiple factors including, the 2020 numbers being negatively impacted by the pandemic and economies across the globe slowly marching towards their pre-pandemic levels.

Furthermore, the large number of vaccines rolled out around the globe, together with the relaxation of government restrictions, will result in the opening of restaurants and bars, boosting the company’s revenue, specifically for beverages.

High inflationary conditions remained a challenge for the consumer packaged goods (CPG) industry as commodity prices and packaging costs continued to compress margins. However, on the commodity side, the company states that its hedging programs are well-positioned to cover the risks.

Moreover, for PepsiCo, a major factor for margin compression has been acquisition-related costs. Management expects these costs to continue to impact the Q2 results as well.

Recent Developments

As per a Reuters report, PepsiCo plans to reduce its sugar content in sodas and iced teas by 25% in the European Union, its second-largest market, by 2025, and reach a 50% cut by 2030.

The E.U. has levied taxes on sweetened drinks in an attempt to deal with obesity issues, thereby pressurizing beverage companies to reduce sugar levels.

The company aims to launch more nutritious snacks by 2025 in hopes of achieving a tenfold increase in sales by 2025 and reaching a $1 billion portfolio by 2030.

On June 24, PepsiCo’s Fritos joined hands with Papa Murphy’s Take ‘n’ Bake Pizza to launch its limited-edition Fritos® Outlaw Pizza, which will be available at Papa Murphy’s locations until September.

Furthermore, on June 8, Frito-Lay announced a $200 million investment in Rosenberg, Texas, to add two manufacturing lines for Funyuns and tortilla chips. The project is expected to complete by 2023 and will create 160 jobs. The site will also ramp up its warehousing capabilities and increase future growth potential.

On May 28, PepsiCo announced an exclusive beverage partnership with FAT (Fresh. Authentic. Tasty.) Brands Inc., under which domestic FAT Brands restaurants will offer customers up to a dozen popular beverage choices from the diverse PepsiCo portfolio. The company’s beverage sales are expected to shoot up with the partnership.

In early May, PepsiCo launched soulboost, a sparkling water beverage with a splash of real juice and functional ingredients, L-theanine, and Panax ginseng. These ingredients help support mental stamina and relaxation and act as a healthy alternative to alcoholic beverages.

Soulboost further establishes PepsiCo as a leader in the enhanced water market, expected to reach $11.3 billion by 2027, according to Grandview Research, 2020.

Analyst Recommendations

On June 29, Morgan Stanley analyst Dara Mohsenian reiterated a Buy rating on the stock with a price target of $165, which implies 10.8% upside potential to current levels.

Mohsenian stated that the second-quarter earnings will be a positive catalyst for the stock. He expects the company to beat organic sales and earnings expectations and to raise its FY21 earnings guidance.

The analyst sees long-term growth prospects for the company, along with a positive near-term outlook.

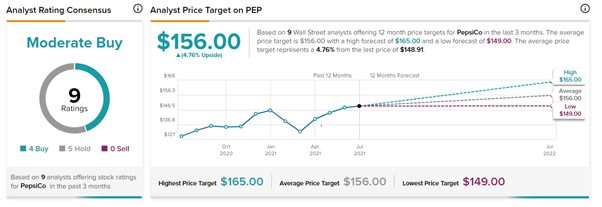

Overall, the stock has a Moderate Buy consensus rating based on 4 Buys and 5 Holds. The average PepsiCo price target of $156 implies 4.8% upside potential to current levels.

Related News:

Virgin Galactic Announces First Fully Crewed Spaceflight; Shares Soar 4%

Santander Consumer USA Receives Acquisition Bid from Santander Holdings USA, Inc.

Shentel Declares $18.75 Per Share Special Dividend; Shares Soar 15.5%