Chip stock Intel (NASDAQ:INTC) slipped in after-hours trading after the Pentagon reportedly scrapped its plan to allocate $2.5 billion in grants to the firm, as per Bloomberg. This development shifts the financial burden onto the U.S. Commerce Department, which must now bridge the funding gap under the U.S. CHIPS and Science Act.

Originally, the Commerce Department was to contribute only $1 billion of the $3.5 billion earmarked for Intel’s development of advanced semiconductors for defense and intelligence purposes. This move aimed to establish Intel as the primary provider for the military and intelligence sectors.

The CHIPS Act, signed into law by President Biden in August 2022, signifies a $53 billion effort to enhance the U.S. economy’s resilience and security. It aims to rejuvenate semiconductor manufacturing within the nation, encouraging companies to localize their production processes. With the Pentagon’s recent decision, the anticipated funding structure and the future of Intel’s role as a specialized semiconductor supplier for defense applications are now under reconsideration.

What Is the Target Price for INTC?

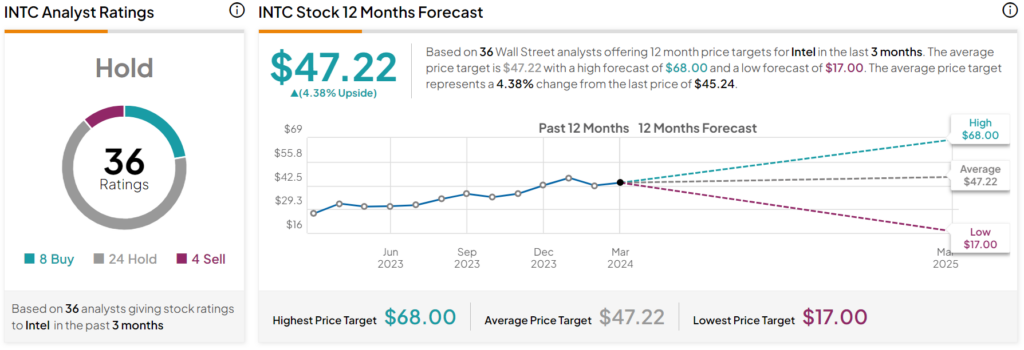

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on eight Buys, 24 Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 70% rally in its share price over the past year, the average INTC price target of $47.22 per share implies 4.4% upside potential.