Shares of exercise equipment and media company, Peloton Interactive Inc. (PTON) hit a new all-time low of $30.35, down 5.6% on Friday, following the news that the company was exiting the financial services firm NASDAQ Inc.’s (NDAQ) Nasdaq 100 index.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Peloton stock has lost 80.2% over the past year against an 11% decline year-to-date. Shares closed down 2.5% at $31.33 on January 14. Meanwhile, the NDX Index gained 115.98 points and closed at 15,611.59 on Friday.

Peloton Exits Nasdaq 100

Peloton witnessed huge demand for its at-home exercise equipment due to the pandemic-triggered lockdowns and restrictions. However, as soon as the economy recovered and restrictions were lifted, demand for its equipment sank and forced the company to lower its full-year fiscal 2021 outlook last November.

Another reason behind the lackluster demand is that the consumers consider its products to be too pricey. People are happy to go back to the gym and cut down on their luxury exercise regime.

The Nasdaq 100 is a market capitalization-based index comprising the largest non-financial companies. On Thursday, Nasdaq announced that Peloton will be exiting its Nasdaq 100 index effective January 24 due to its low market cap. The company will be replaced by the less than truckload shipping firm Old Dominic Freight Line, Inc. (ODFL).

Consensus View

Responding to the news, Truist Financial analyst Michael Swartz reiterated a Hold rating on the stock. Swartz stated that after surveying 1,400 exercise enthusiasts, the results showed that the at-home exercise habit is here to stay.

Despite the reopening of the economy, the analyst’s survey showed that people who have been habituated to exercising in their home’s comfort will continue to do so. Thereby, believing that the at-home fitness total addressable market (TAM) is poised for drastic growth.

Overall, the stock has a Moderate Buy consensus rating based on 10 Buys, 15 Holds, and 2 Sells. The average Peloton price target of $68.14 implies a whopping 117.5% upside potential to current levels.

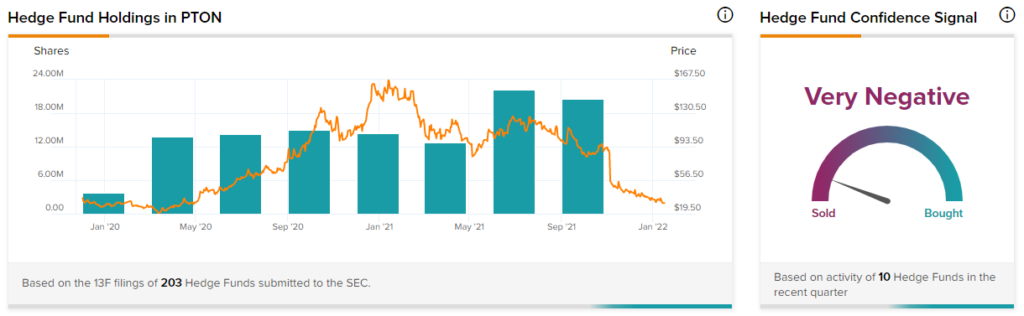

Hedge Fund Activity

According to TipRanks’ Hedge Fund Trading Activity tool, confidence in PTON is currently Very Negative, as 10 hedge funds decreased their cumulative holdings of the PTON stock by 1.7 million shares in the last quarter.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Jack Dorsey’s Block to Build an Open Bitcoin Mining System

Meta’s Facebook Faces $3.2B U.K. Class Action Lawsuit

Visa Launches Visa Acceptance Cloud Platform for POS Payments