Shares of Peloton Interactive (PTON) plummeted over 30%on Friday, after reporting disappointing first-quarter results with earnings and revenue both failing to meet expectations.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The American exercise equipment and media company posted a quarterly loss of $1.25 per share, 18 cents lower than the estimated loss of $1.07 per share. The company reported diluted earnings of $0.20 per share in the same quarter last year.

Moreover, total revenue rose 6% year-over-year to $805.2 million, missing Street estimates of $810.76 million. Peloton’s quarter-end total members increased to over 6.2 million, with Connected Fitness subscriptions growing 87% and Paid Digital subscriptions growing of 74% compared to the same quarter last year.

See Analysts’ Top Stocks on TipRanks >>

The company said, “While we are reducing our near-term forecast, our confidence in and commitment to our strategy is unchanged. Software and streaming media have redefined at-home fitness and are driving a migration of workouts into the home, a consumer behavioral shift that we believe is still in its early stages. This trend was well-underway prior to the pandemic, and has clearly been accelerated by the growing awareness and adoption of Connected Fitness over the past year and a half.”

Guidance

Challenged visibility into near-term operating performance has led the company to lower its fiscal year guidance, after noting that FY 2022 would be a difficult year to forecast amid the global supply chain disruptions and commodity price pressures.

Peloton now forecasts Q2 2022 total revenue to fall in between $1.1 billion to $1.2 billion, lower than the consensus estimates of $1.51 billion.

Additionally, FY 2022 revenue is projected to fall in the range of $4.4 billion to $4.8 billion, while the consensus is pegged higher at $5.4 billion.

Wall Street’s Take

Disappointed by Peloton’s poor Q1 performance and lowered outlook, analyst Scott Devitt of Stifel Nicolaus downgraded the stock to a Hold rating from Buy, while lowering the price target to $70 (22.3% upside potential) from $120.

Devitt said, “While we continue to view new product introductions and market expansion as drivers of long-term growth, we see fewer near-term catalysts as the company works through several quarters of challenging compares, reopening economies, and cost pressures related to supply chain constraints and commodity prices that limit overall visibility.”

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 13 Buys, 12 Holds, and one Sell. The average Peloton price target is $93.39, which implies 62.9% upside potential to current levels. Shares have lost 31.4% over the past year.

Website Traffic

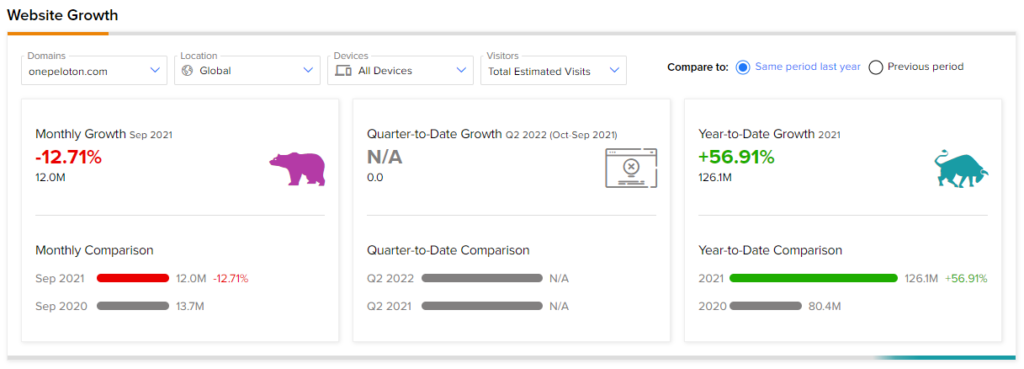

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Peloton’s performance.

According to the tool, in September, the Peloton website recorded a 12.7% monthly decline in global visits compared to the previous year. On a positive note, year-to-date website traffic growth has increased 56.9% against the same period last year.

Related News:

Skillz Drops 10% on Quarterly Loss

Qualcomm Posts a Blowout Quarter; Shares Jump 7.5%

Roku’s Q3 Revenues & Q4 Outlook Disappoint