Exercise equipment maker Peloton (NASDAQ:PTON) was on top of the world about four years ago, during the worst of the pandemic, as a population that could no longer go to the gym by federal mandate instead built home gyms and tapped Peloton to stock them. But when gyms reopened, that picture soured, and now Peloton may be facing a cash crunch. However, shareholders shrugged these reports off and sent shares up fractionally in Thursday afternoon’s trading.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

New reports from Creditsafe suggest that Peloton is running behind on payments to vendors, and that’s not a unique situation, either. That same Creditsafe report also points to Saks, Express (OTHEROTC:EXPR), and Bath & Body Works (NYSE:BBWI) are having increasing problems with covering costs to their vendors. While that’s not automatically a sign of trouble—businesses will often take full advantage of terms, or even pay late, to improve their cash positions—it certainly can be, especially if it goes on for an extended period.

The Creditsafe reports also noted that these retailers were running farther behind than normal. That deviation suggests trouble, noted B. Riley Securities’ head of restructuring Perry Mandarino, who called it “…generally a telltale sign of financial distress.” Mandarino starkly noted, “It’s either they have liquidity issues, or they don’t care.”

“Almost Unrecognizable”

That point was underscored by one analyst, who referred to Peloton’s current business model as “night and day different from four years ago.” That’s indeed the case; after all, it mostly sold exercise equipment four years ago, though it started to add on streaming exercise programs as kind of a sidebar. But now, that streaming operation has surged to become a much larger part of the operation. Peloton is much more about “fitness-as-a-service,” and if that turns out to be a major field, Peloton is likely to win. Though that’s a fairly hefty “if.”

Is Peloton a Buy, Sell, or Hold?

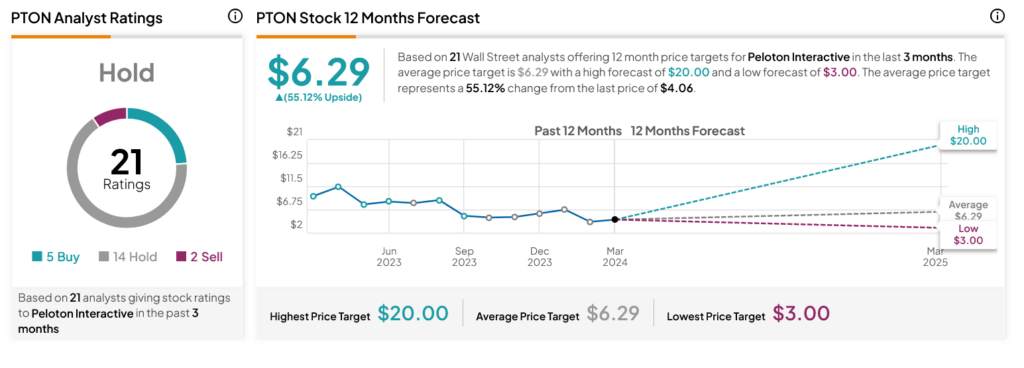

Turning to Wall Street, analysts have a Hold consensus rating on PTON stock based on five Buys, 14 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 63.48% loss in its share price over the past year, the average PTON price target of $6.29 per share implies 55.12% upside potential.